Advantages Of Gst In Malaysia

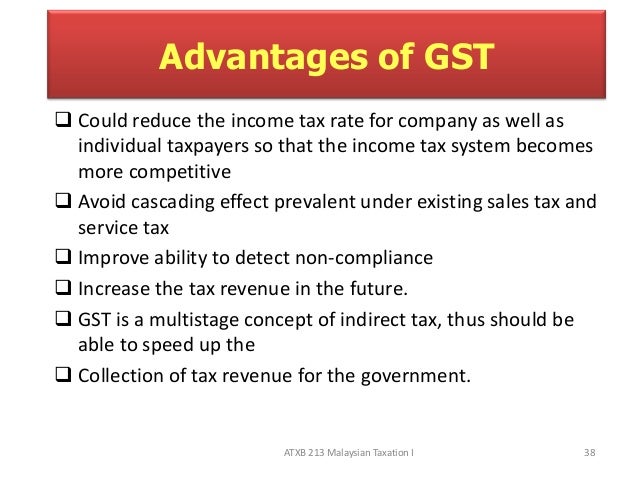

There are some advantage and give the good effect to the society and country.

Advantages of gst in malaysia. What your opinion when gst were implementing in malaysia. In contrast to the sales tax and service tax is a single stage tax the gst is a tax. It is more efficient than the other tax which sales and service tax sst. Compared to any other tax registration process gst registration in malaysia can be done with.

Advantages of gst goods and service tax gst is a good tax system that has been applied in malaysia and some country. Advantages of gst in malaysia goods and services tax or gst is a consumption tax based on the concept of added value. Easy and simple registration process. Let us see what benefits and drawbacks gst brought to the economy.

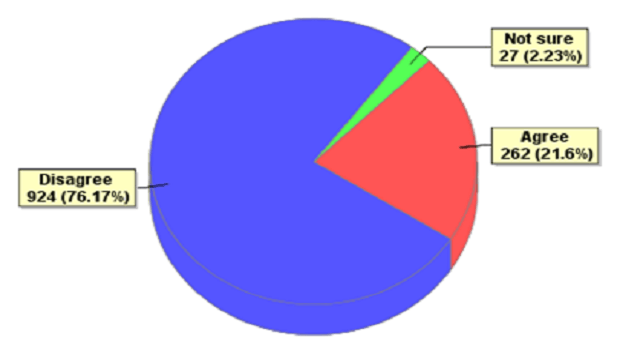

Everyone will pay tax and tax burden is spread over instead of just relying on income taxes derived from 15 of the working population. But the launch was postponed due to avid criticism and the tax pm nally came into effect on 1 april 2015. The advantages disadvantages of gst in malaysia. The gst is basically a form of taxation system imposed by the government where there is a single tax in the economy that is placed upon goods and services offered.

Like any other reform in the country even gst has had its pros and cons in malaysia. Gst has advantages to certain degree because the revenue increased is not just from local people but from the foreigners too. It is more efficient than the other tax which sales and service tax sst. Advantages and disadvantages of gst in malaysia 831 words 4 pages.

Advantages of gst goods and service tax gst is a good tax system that has been applied in malaysia and some country. 5 28 2018 advantages and disadvantages of gst in malaysia business setup worldwide 1 7 the goods and services tax gst was pm rst planned to be introduced in the 3 quarter of 2011 by the government of malaysia. Payment of tax is made in stages by the intermediaries in the production and distribution process. Tax burden will not increase when income level increased.

One of its greatest benefits is the elimination of the possibility of paying double taxes because the two pronged tax rates and policies in the sst system would have been replaced by one single gst. The primary objective behind the new and improved gst tax system in. The gst which is set to replace the sst is a far more comprehensive and transparent tax system that will ultimately benefit the consumers. The goods and services tax gst has been in effect for a while now in malaysia.

There are some advantage and give the good effect to the society and country.