Amount Due From Director Meaning

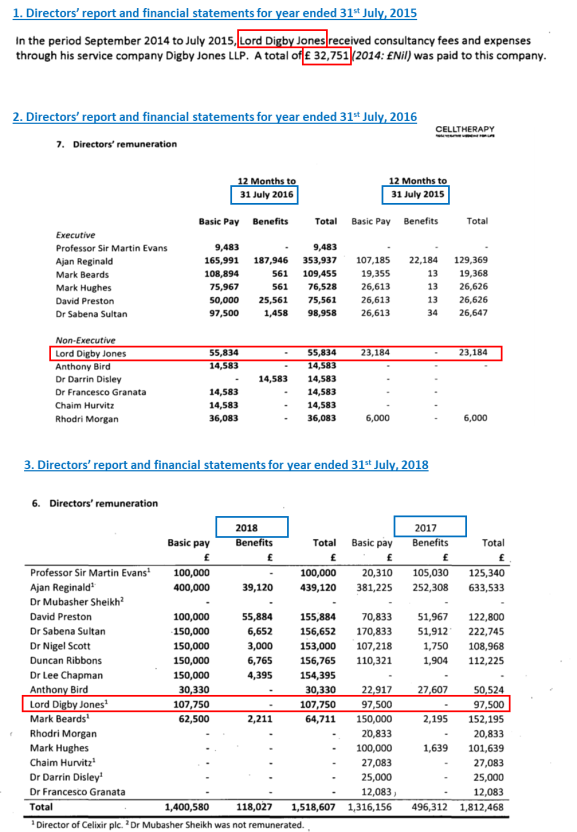

Amount due from director is what is due from the director.

Amount due from director meaning. The amount of loan written off will have to be included in the director s self assessment tax return on a specific box on the additional information pages. Amounts due to the director from the company should be recorded in the company s books as a creditor while the amounts due from the director to the. The loan amount benefit in kind calculation and interest payments should still be shown on the form p11d. Director has made payment settlement to supplier using his own personal bank account.

Amount due could be for loans made from the director to the company or due to the director for services rendered. A collection or mass. The amount of director s fees voted and approved on 9 dec 2019 was therefore approved in advance and the directors were not entitled to the director s fees on 9 dec 2019. If the loan does not exceed 5 000 in.

I m not sure what the question is. Amount due to director is what is due the director. Meaning you don t have to pay. A collection or mass especially of something that cannot be counted.

Amount due to director but im not sure how to do it in qb. Accounting entry should be. For income tax purposes the amount is treated as dividend with the usual tax credit. Amount due from director could be for a loan made by the company to the director so the director owes the company or perhaps for goods or services provided to the director from the company for which the director owes the company.

If you own the director 10 and he owes 5 the director got 5 bucks left right. Kantak konwar 6 that in spite of acknowledging the liability of salary of principal balance rs. This is because they have yet to perform requisite services for the accounting year ending 31 dec 2020. Supplier expenses credit.

176000 00 you have been miserably failed to make payment of the said amount due to from you deliberately with malafide intent.

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

:max_bytes(150000):strip_icc()/ExxonMobilCashflowstatement09-30-2018-5c671f2e46e0fb0001a20a17.jpg)

/ExxonMobilCashflowstatement09-30-2018-5c671f2e46e0fb0001a20a17.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)