Benefit In Kind Malaysia 2018

Perquisites means benefits that are convertible into money received by an.

Benefit in kind malaysia 2018. Common benefits in kind biks some of the common biks include. Examples of consumable services are dental care childcare benefits food drinks specially arranged transportation between pick up points and special discounts for consumable products that cannot be resold such as food or toiletries etc. The benefit is provided to him throughout the year 2018. Objective the objective of this public ruling pr is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and.

Certain benefits in kind pertaining to consumable services are not eligible for taxation. Car and related benefits provided to employees for private usage. These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no. As announced by the prime minister at budget 2018 the m40 incentive consists of a 2 point tax rate reduction which is aimed to help approximately 2 3 million malaysians earning between rm20 001 and rm70 000.

3 2013 inland revenue board of malaysia date of issue. 2 2004 issued on 8 november 2004. Benefits in kind are benefits provided by or on behalf of your employer that cannot be converted into money. Residential accommodation provided to employees.

Regardless of what they re called you have to keep track of the additional benefits given to you because they may either be taxable or tax exempt. These benefits are normally part of your taxable income except for tax exempt benefits which will not be part of your taxable income. 2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable. All income of persons other than a company limited liability partnership co operative or trust body are assessed on a calendar year basis.

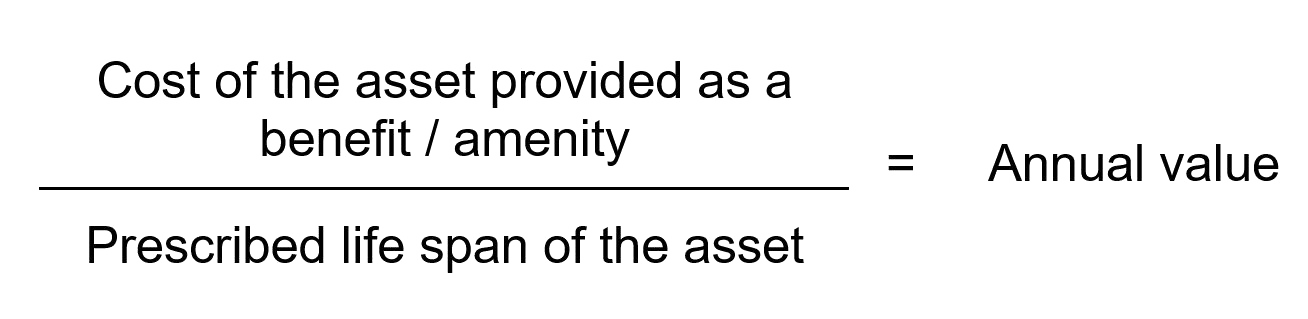

3 2013 date of issue. Assets provided to employees for private usage phone furniture fittings household appliances etc. 15 march 2013 pages 3 of 31 b any appointment or office whether public or not and whether or not that relationship subsists for which the remuneration is payable. A further clarification on benefits in kind in the form of goods and services offered at discounted prices.

Malaysia adopts a self assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer. The cost of the motorcar is rm81 000. Benefits in kind are also a type of benefit received by employees which are not included in their salary such as cars furniture and personal drivers. Benefits in kind public ruling no.

June 2018 is the fy ending 30 june 2018.