Capital Expenditure And Revenue Expenditure Examples

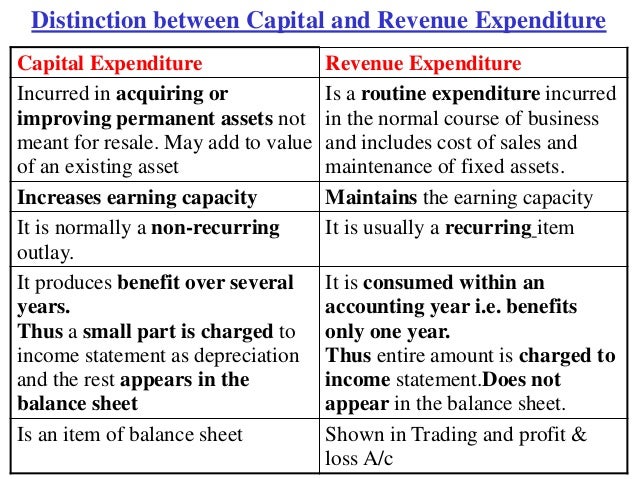

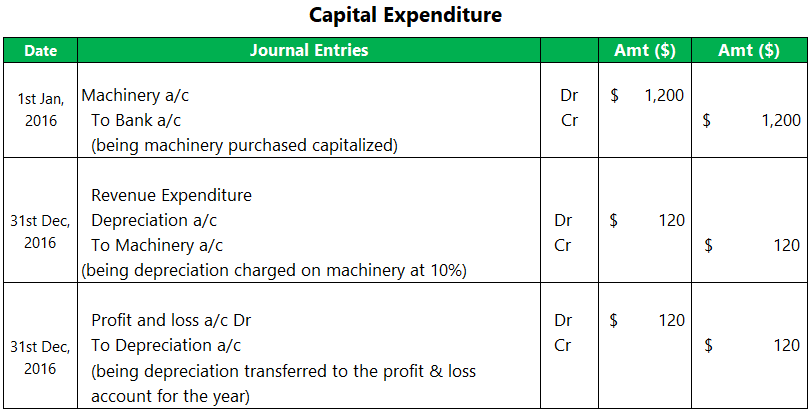

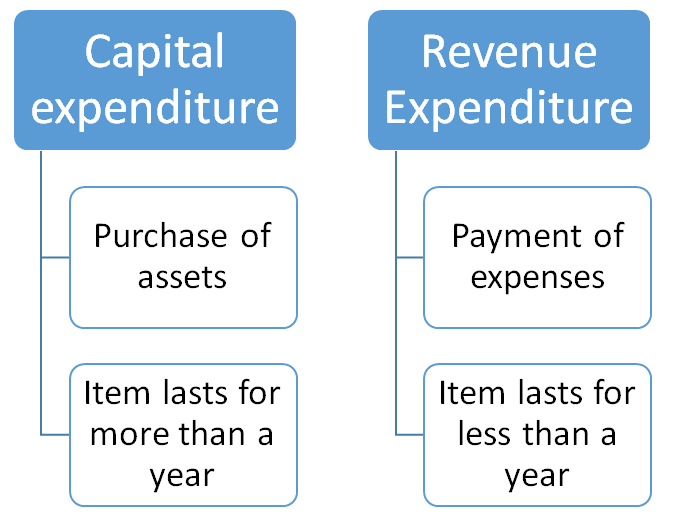

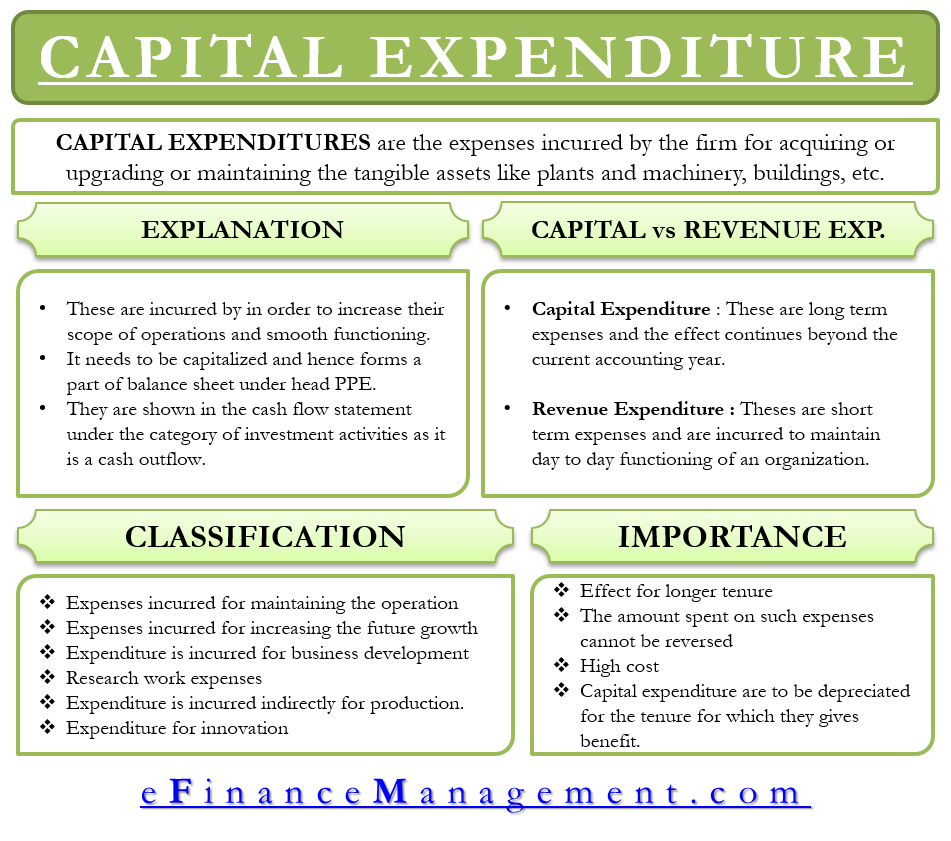

Capital expenditure constitutes those expenses that are typically incurred while acquiring capital assets or upgrading the current ones.

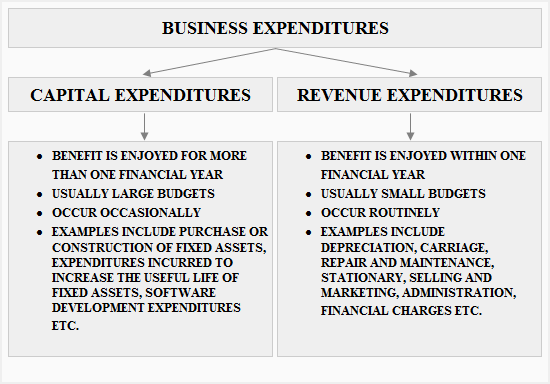

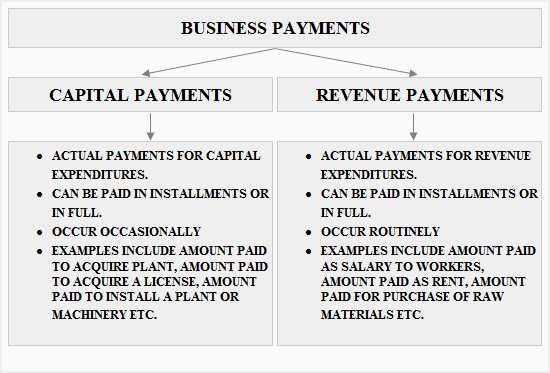

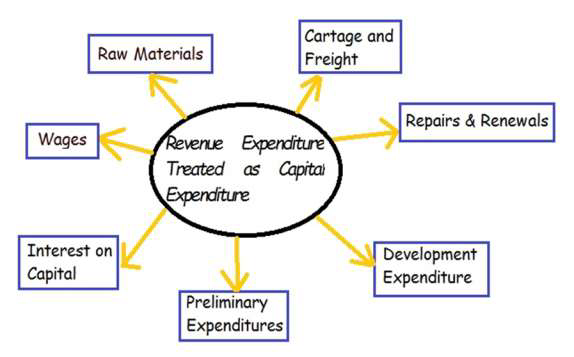

Capital expenditure and revenue expenditure examples. The business expenditures are of two types capital expenditures revenue expenditures capital expenditures definition and explanation of capital expenditures. Below is a truncated portion of the company s income statement and cash flow. Revenue expenditures is the item of expenditures which benefits may expire within an accounting period. Capital expenditure may include the following expenditures expenditure incurred on the acquisition of fixed assets tangible.

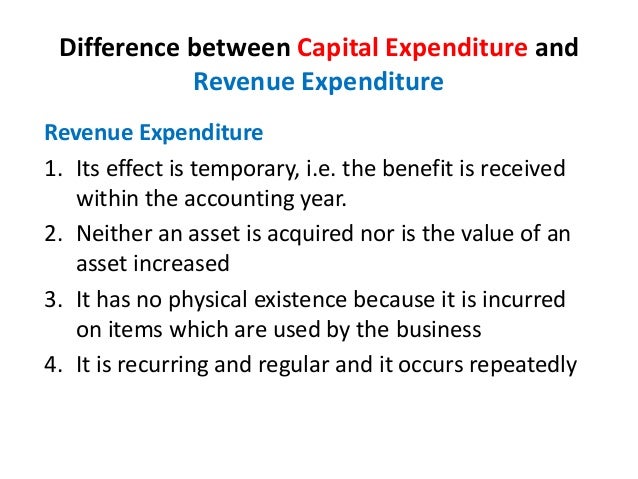

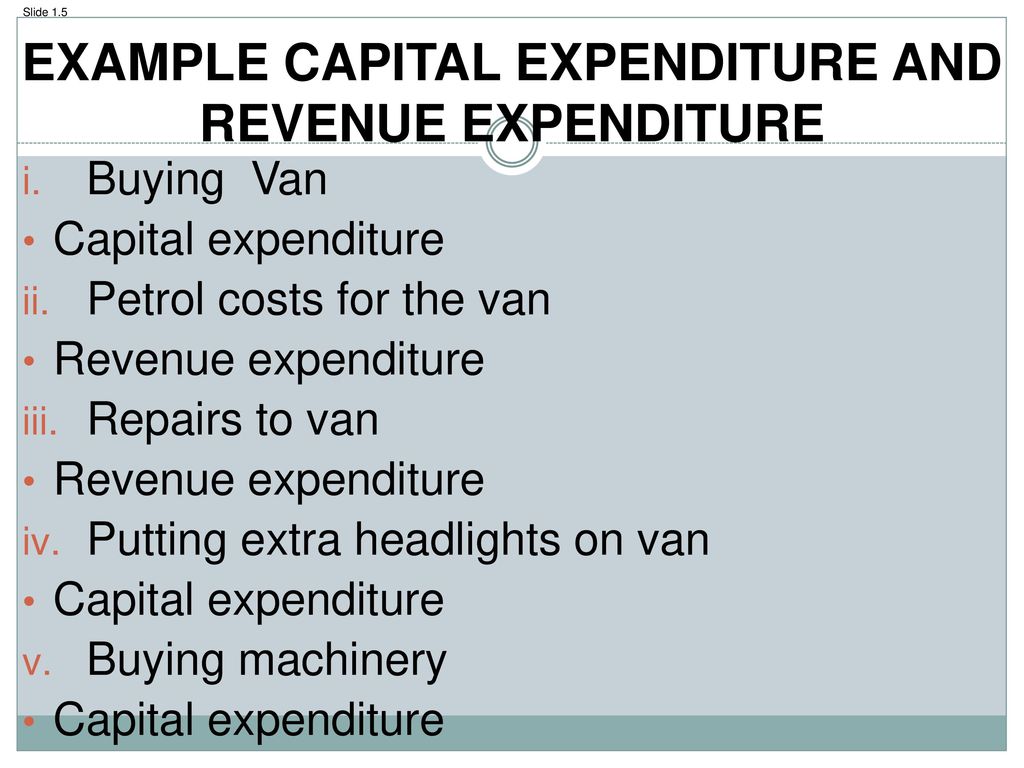

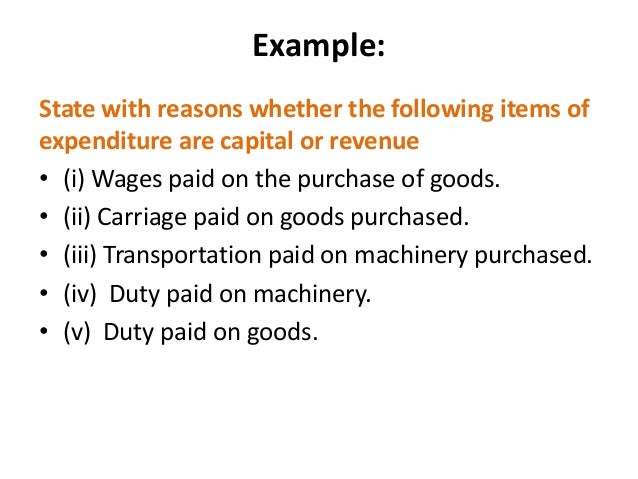

Examples of revenue and capital expenditures. Is an automobile manufacturer of electric vehicles. These expenditure will not increase the efficiency of the business. An expenditure is a capital expenditure if the benefit of the expenditure extends to several trading years.

If a company deals in computers and opens a new branch at a different location for which it acquires a building. Example of capital and revenue expenditures. They can be fully deducted when computing taxes. Capital expenditure capital expenditure includes costs incurred on the acquisition of a fixed asset and any subsequent expenditure that increases the earning capacity of an existing fixed asset.

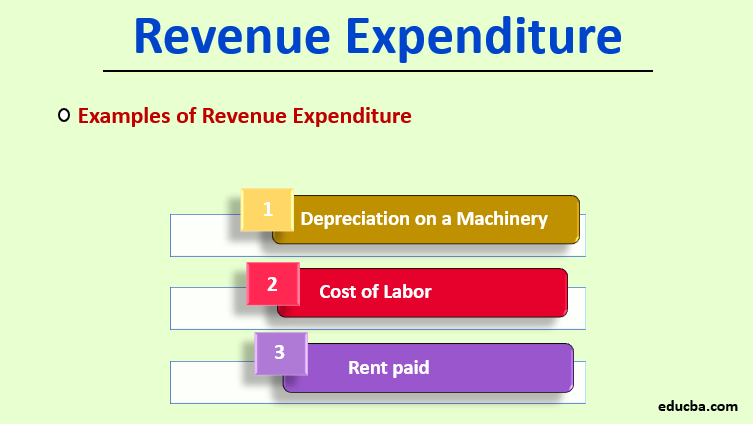

Revenue expenditure refers to those expenditures which are incurred during normal business operation by the company benefit of which will be received in the same period and the example of which includes rent expenses utility expenses salary expenses insurance expenses commission expenses manufacturing expenses legal expenses postage and printing expenses etc. The expenses a firm incurs each day to maintain its daily business activities are revenue expenditure. Revenue expenditure is made during the. Capital expenditures are a long term investment meaning the assets purchased have a.

The acquisition of the building will be a capital expenditure while the purchase of computers will be a revenue expenditure. But the range is wider than that. Routine repair update costs on equipment. A capital expenditure capex is the money companies use to purchase upgrade or extend the life of an asset.

Smaller scale software initiative or subscription. So far we ve spoken mainly about physical revenue expenditures. They re listed on the income statement to calculate the net profit of any accounting period. Are the some example of revenue expenditure.

Revenue expenditures are matched against revenues each month it is not reflected on the balance sheet the way a capital expenditure is.