Capital Expenditure And Revenue Expenditure Ppt

To enable a true and fair view of financial statements 3.

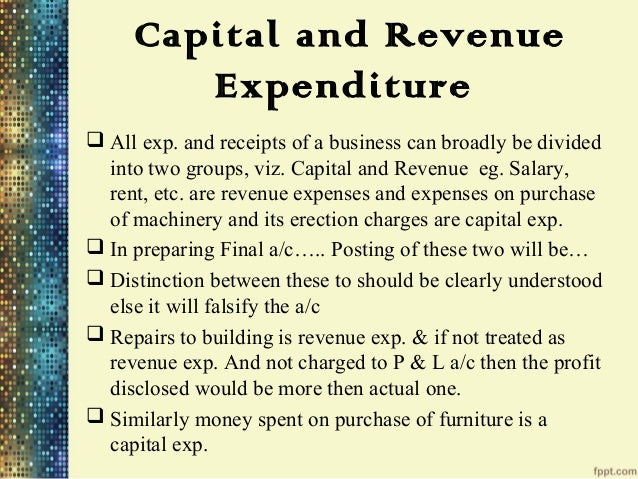

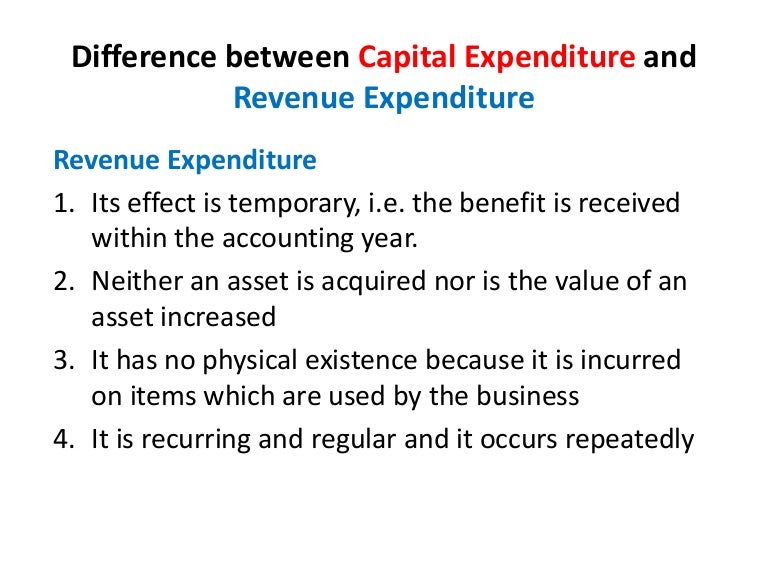

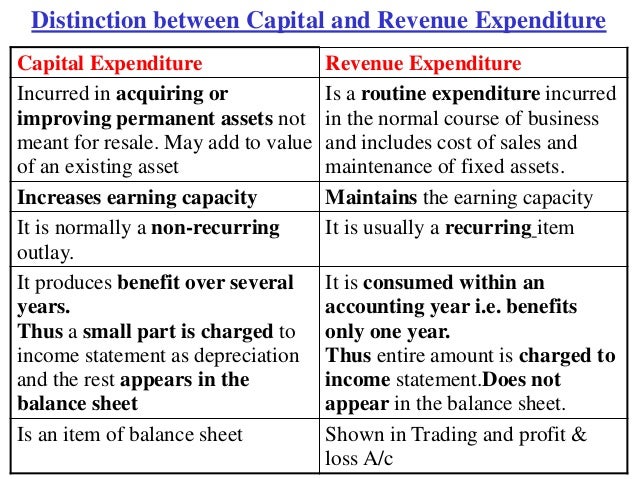

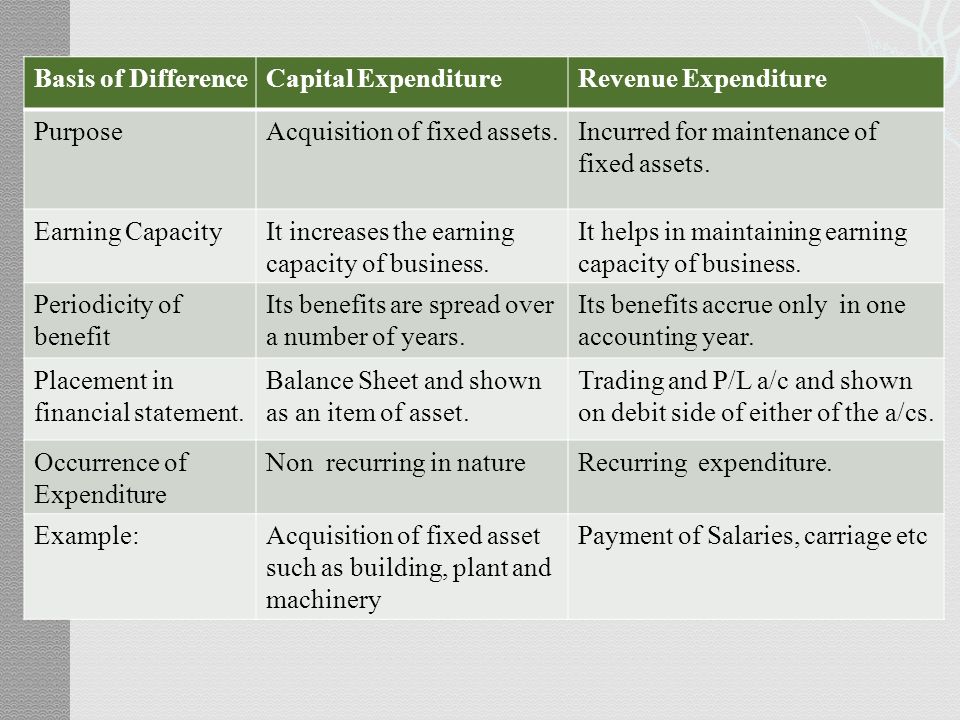

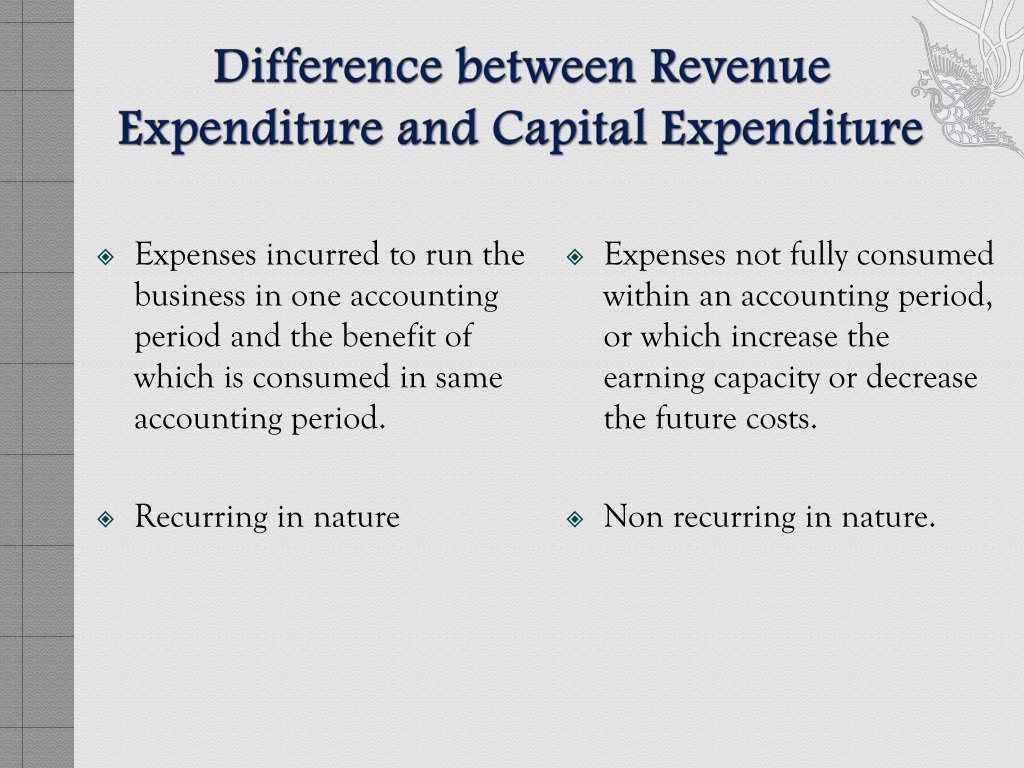

Capital expenditure and revenue expenditure ppt. Its effect is temporary i e. Difference between capital expenditure and revenue expenditure 1. Capital expenditure buy fixed assets or add to the value of an existing fixed asset. The benefit is receivedwithin the accounting year 2.

Capital versus revenue expenditure. B revenue expenditure is money spent on the daily running expenses of the business. A capital expenditures b revenue expenditures c capital receipt d revenue receipt 20. Neither an asset is acquired nor is the value of anasset increased3.

Need to classify expenses into capital and revenue 1. The reason for charging depreciation to revenue i e. Amount received from idbi as a medium term loan for augmenting working capital. The major difference between the two is that the capital expenditure is a one time investment of money.

Examples of differences between capital and revenue expenditure. Purchase a building rent a building. To adhere to matching principle 2. Capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only.

C capital expenditures d revenue expenditures 19. The amount of depreciation is a revenue expenditure and is debited to profit and loss account. Revenue expenses are short term expenses to meet the ongoing operational costs of running a business. T 4 capital and revenue expenditure free download as powerpoint presentation ppt pdf file pdf text file txt or view presentation slides online.

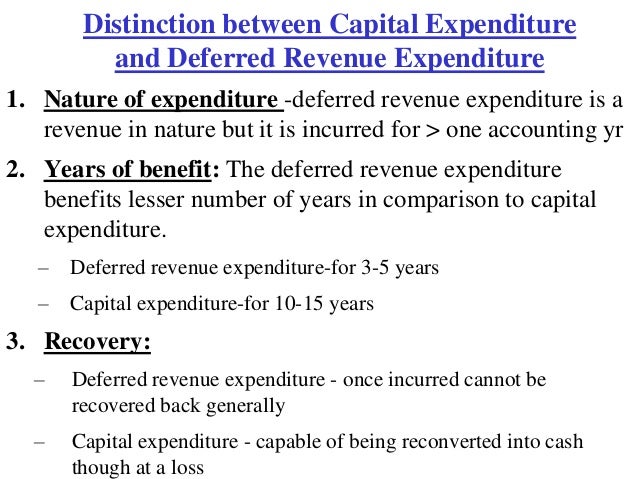

Heavy advertisement expenditure the most important factor affecting the classification is the nature of business. These expenditures must be added to the cost of non current assets account. This expenditures will increase the value of the non current assets in the statement of financial position and the capital of the business. Key differences between capital and revenue expenditure.

Revenue expenditure day to day running of business. Capital expenditure revenue expenditure. On the contrary revenue expenditure occurs frequently. Capital and revenue expenditure.

Profit and loss account is that the asset is used for earning revenue. A capital expenditure b revenue expenditure. 2 500 spent on the overhaul of machines purchased second hand. Think it over buying a van petrol costs for van repairs to van putting extra headlights on van buying machinery electricity costs of using machinery painting outside of new building.

16 capital expenditure examples the cost of assets will be written off by way of depreciation over a period of its life. Capital expenditures are major investments of capital to expand a company s business. 1 heavy research expenditure 2.