Capital Expenditure And Revenue Expenditure

Both have benefits for business.

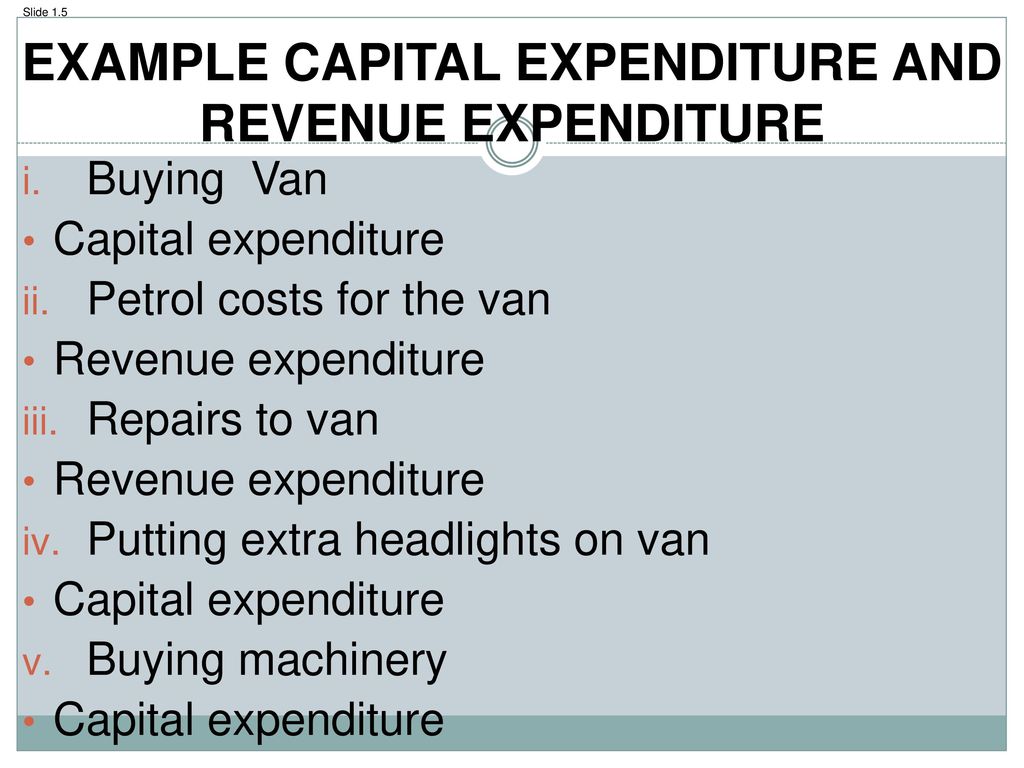

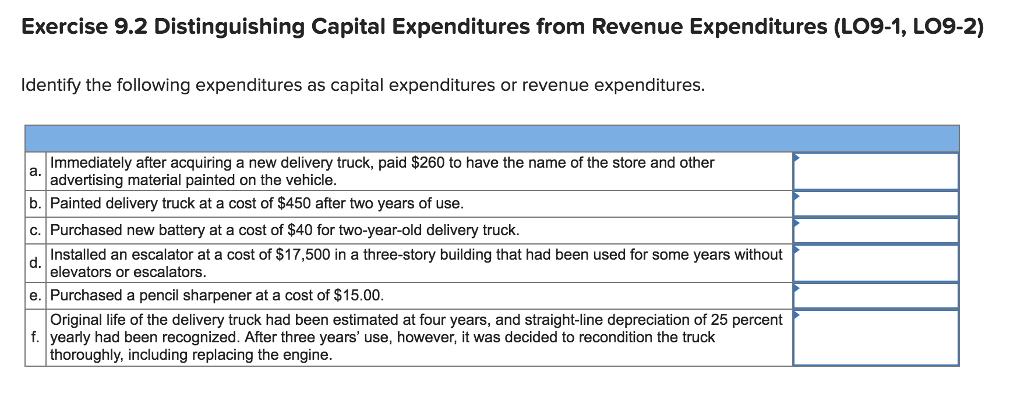

Capital expenditure and revenue expenditure. It s not enough to say that capital expenditures are everything that revenue expenditures aren t. The cost of acquisition not only includes the cost of purchases but also any additional costs incurred in bringing the fixed asset into its present location and condition e g. In the case of a capital expenditure an asset has been purchased by the company which generates revenue for upcoming years. What is a capital expenditure versus a revenue expenditure.

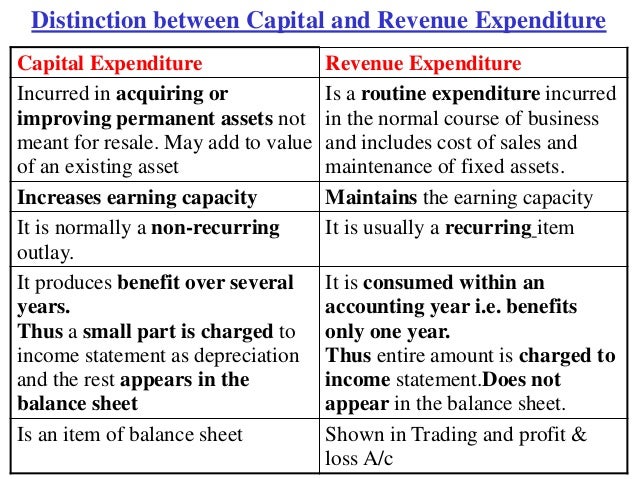

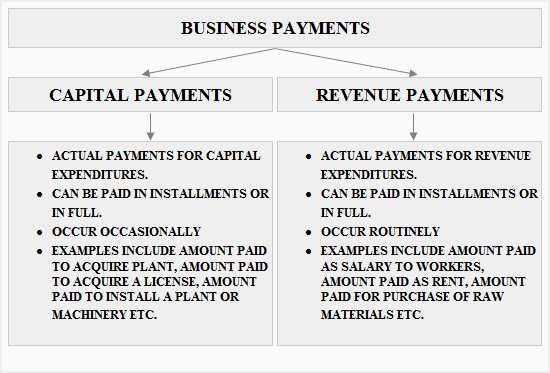

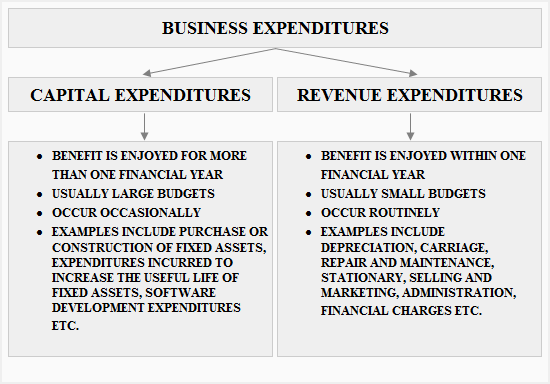

They break down differently depending on the size of the payment and the time across which it needs to be paid for. Capital expenditure includes costs incurred on the acquisition of a fixed asset and any subsequent expenditure that increases the earning capacity of an existing fixed asset. Capital expenditure and revenue expenditure both are important for business for earning a profit in the present as well as in subsequent years. While on the other hand capital expenditure is the long term investment that only benefits the business.

Capital expenditures are major investments of capital to expand a company s business. Usually the cost is recorded in a balance sheet account that is reported under the heading of property plant and equipment. Capital expenditures are charged to expense gradually via depreciation and over a long period of time. It is an amount spent to buy a non current asset.

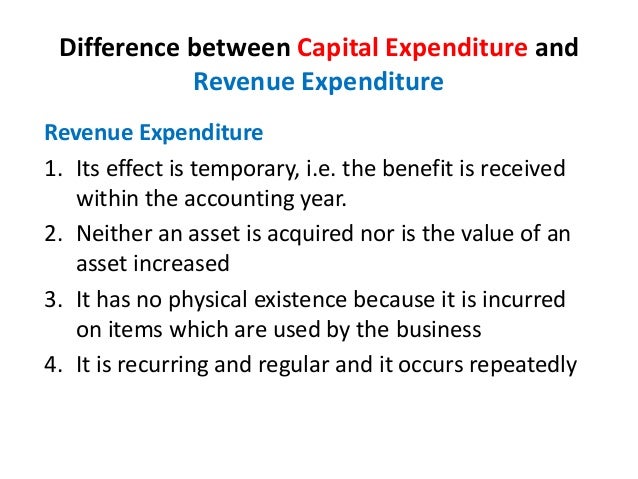

On the contrary revenue expenditure is short run. It not depleted within an existing accounting year. Definition of capital expenditure. Its benefits received within the existing accounting year.

With a capital expenditure a company purchases an asset which helps generates profits for the future. Revenue expenditures are charged to expense in the current period or shortly thereafter. Capital expenditure is a long term expenditure and accordingly has a long run effect on the business. A capital expenditure is an amount spent to acquire or significantly improve the capacity or capabilities of a long term asset such as equipment or buildings.

A capital expenditure is assumed to be consumed over the useful life of the related fixed asset. Revenue expenses are short term expenses to meet the ongoing operational costs of running a business. Both help the business earn profits in present in and in following years. S no capital expenditure revenue expenditure.

Plus capital expenditures will show up differently on your reporting metrics. It is an amount spent to meet the day to day running costs of the business. Revenue expenditure is a periodic investment of money that does not benefit the business nor leads to any loss in any way.