Definition Of Capital Expenditure And Revenue Expenditure

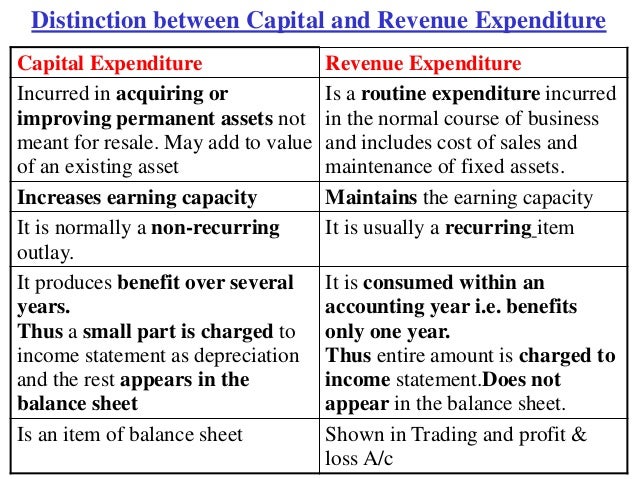

The amount spent or incurred on acquiring a non current asset is treated as capital expenditure.

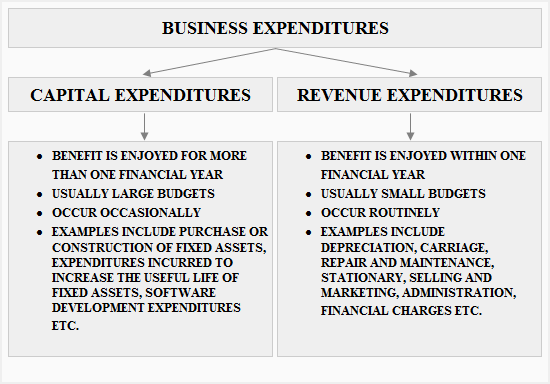

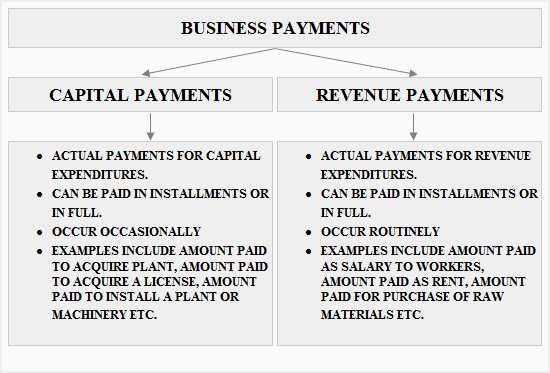

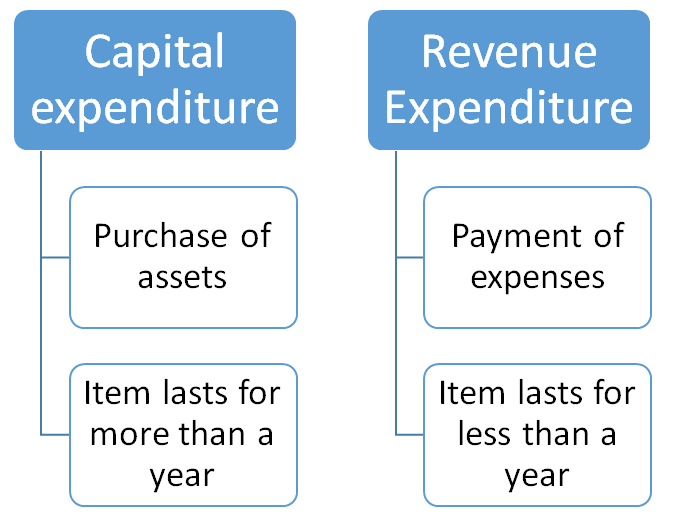

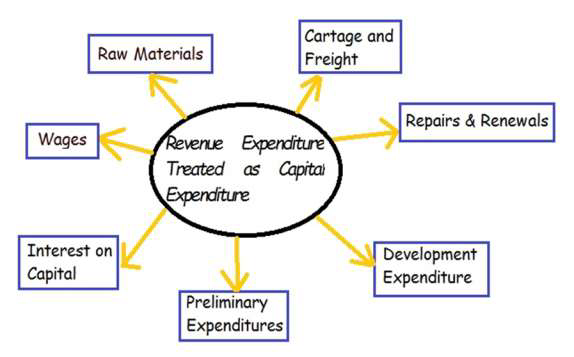

Definition of capital expenditure and revenue expenditure. Capital expenditures are major investments of capital to expand a company s business. Capital expenditure definition explanation and examples. The business expenditures are of two types capital expenditures revenue expenditures capital expenditures definition and explanation of capital expenditures. An expenditure is a capital expenditure if the benefit of the expenditure extends to several trading years.

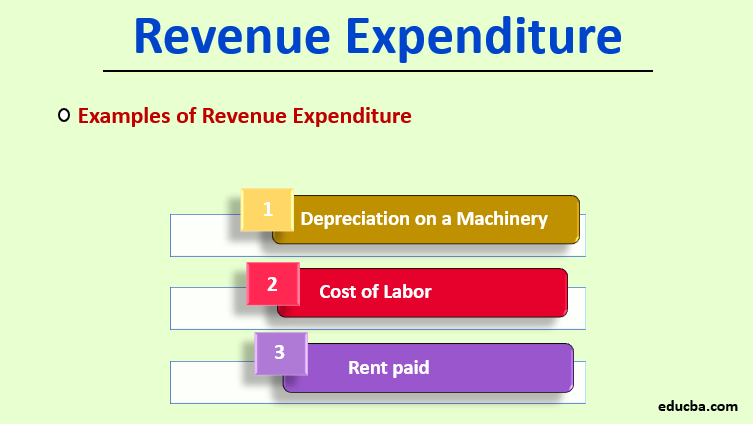

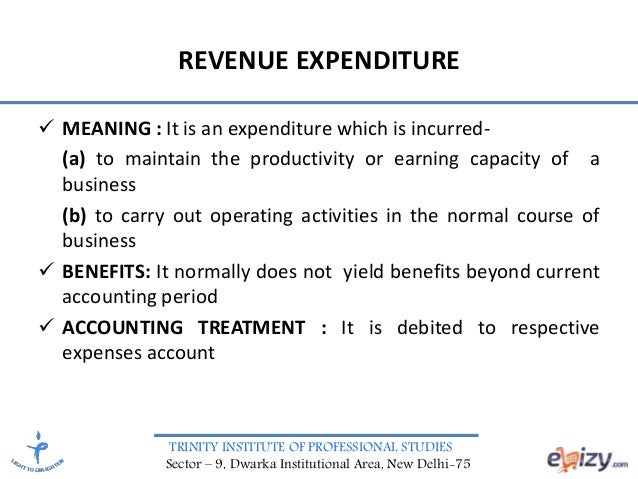

Capital expenditure may include the following expenditures expenditure incurred on the acquisition of fixed assets tangible. A business expenditure is an outflow of economic resources mostly in the form of cash and cash equivalents as a result of undertaking various activities during the normal course of business and to further the. Revenue expenses are short term expenses to meet the ongoing operational costs of running a business. Expenditure is an amount incurred by a business to purchase assets and reduction of liabilities of business.

Definition of capital expenditure.