Differentiate Between Capital Expenditure And Revenue Expenditure

Capital expenditures capex are funds used by a.

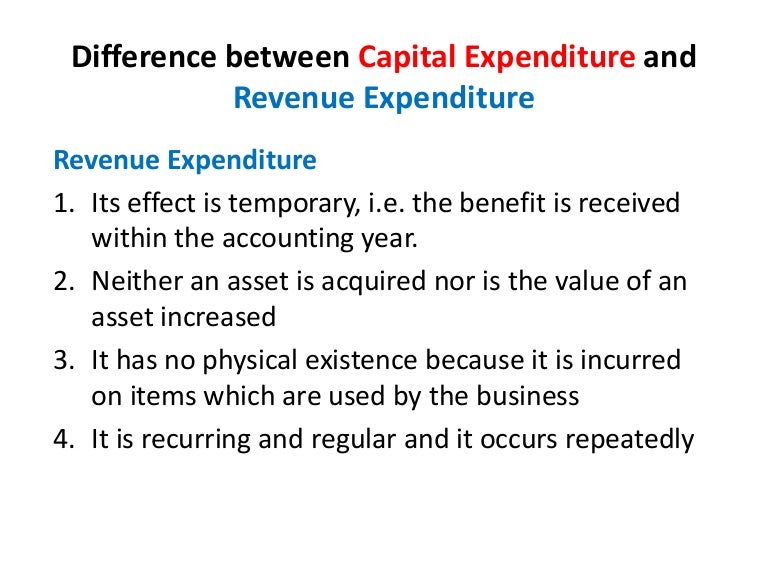

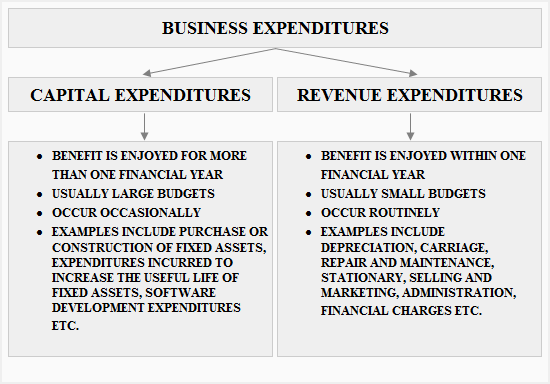

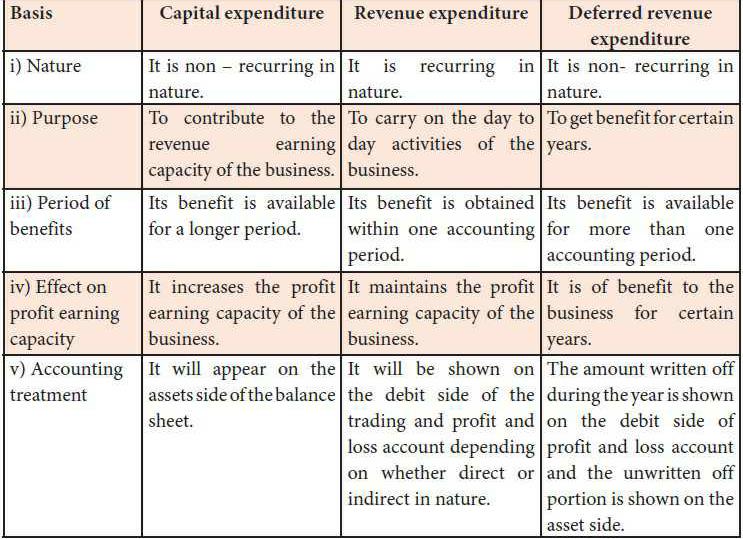

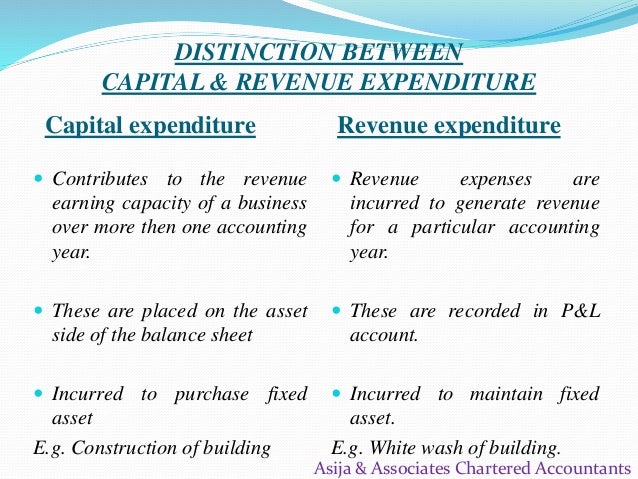

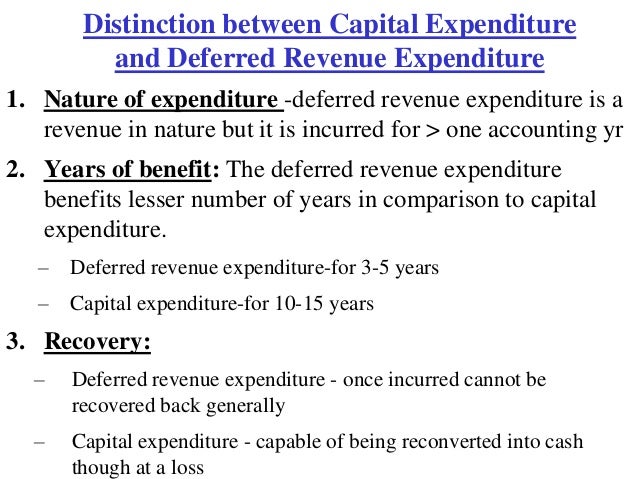

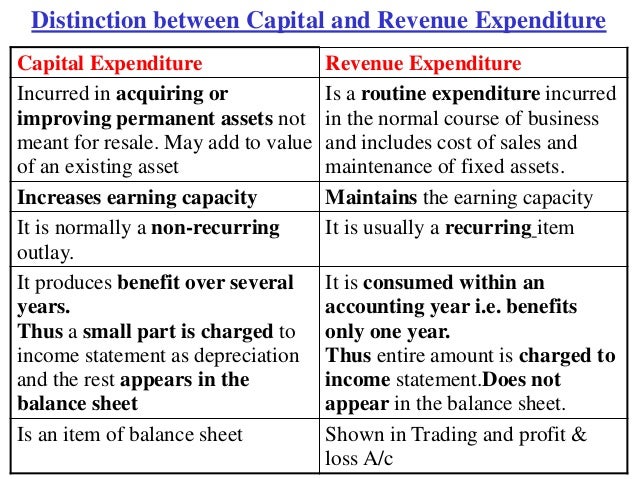

Differentiate between capital expenditure and revenue expenditure. The most significant difference between revenue and capital expenditure is that the capital expenditure is meant to improve the general earning. The first and foremost difference between the two is capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only. The difference between capital expenditure and revenue expenditure are expained in tabular form. Capital expenditures are for fixed assets which are expected to be productive assets for a long period of time.

Revenue expenditures are for costs that are related to specific revenue transactions or operating periods such as the cost of goods sold or repairs and maintenance expense thus the differences between these two types of expenditures are as follows.