Epf Contribution Rate 2019 20 For Employer

Now let s have a look at an example of epf contribution.

Epf contribution rate 2019 20 for employer. The union labour minister santosh gangwar announced the new interest rates for epf on 3rd march 2020. 2 3 67 of employer s share in epf of 20000 inr 734. Let assume the basic salary of a person is inr 20 000. For more information check out related articles uan registration uan login pf balance check epf claim status.

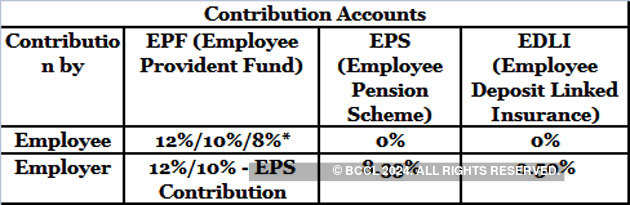

The interest rate for the scheme has been revised and lowered by 0 15 for the current financial year. For sick units or establishments with less than 20 employees the rate is 10 as per employees provident fund organisation s epfo guidelines. As part of the government s atma nirbhar bharat package in may 2020 finance minister nirmala sitharaman announced that monthly epf contributions of both employers and employees was to be reduced from 24 per cent to 20 per cent for the months of may june and july 2020. If the employer pays a higher amount the employer does not have to pay a higher rate as well.

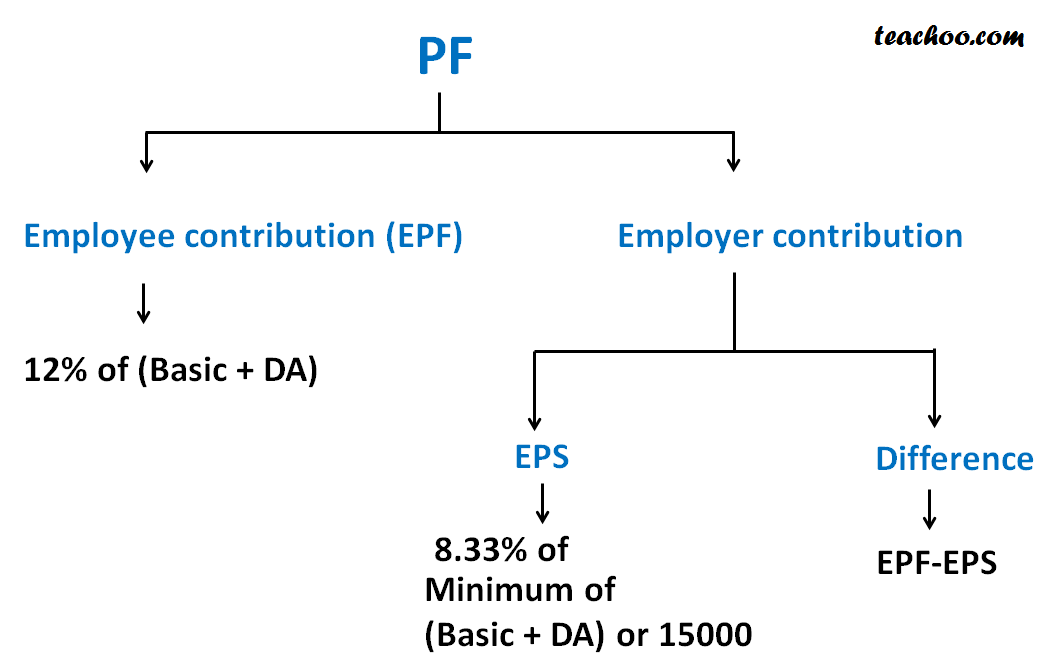

1 12 of employees share in epf i e. To pay contribution on higher wages a joint request from employee and employer is required para 26 6 of epf scheme. So below is the breakup of epf contribution of a salaried person will look like. This is maintained by the employees provident fund organization of india.

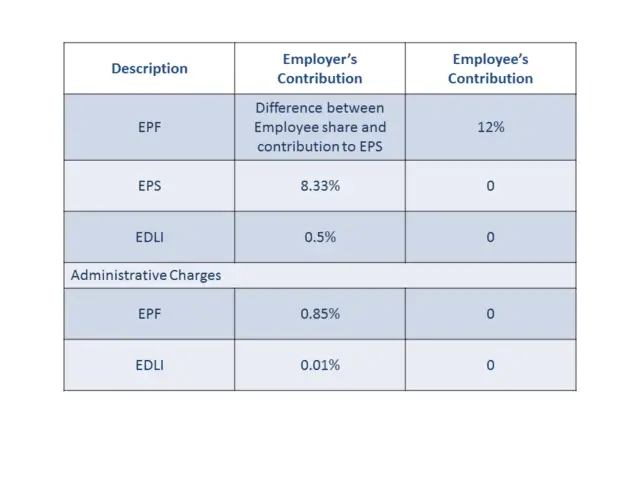

Employee contribution epf 12 20000 2400 employer contribution eps 8 33 15000 1250 difference 2400 1250 1150 total employer pf 1250 1150 2400 note even if pf is calculated at higher amount for eps we will take 15000 limit only remaining amount wil go to difference. For 2019 20 the interest rate is 8 50 which is reduced from the earlier 8 65 per cent. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. Pf contribution rate of employee and employer was defined as per epf act and mandatory to follow.

15000 the employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. Under epf the contributions are payable on maximum wage ceiling of rs. Also as per budget 2018 the rate of interest applicable on epf is 8 65. Employers are required to remit epf contributions based on this schedule.

Since the reduced employees provident fund epf contribution amount was for three months till july from august. 12 of 20000 inr 2 400. If the maximum wage ceiling is rs 15 000 contributions are mandatory. Any company over 20 employees is required by law to register with epfo.

This is a retirement benefit scheme that is available to the salaried individuals. During this period your employer s epf contribution will remain 12.