Epf Contribution Rate 2019

Any company over 20 employees is required by law to register with epfo.

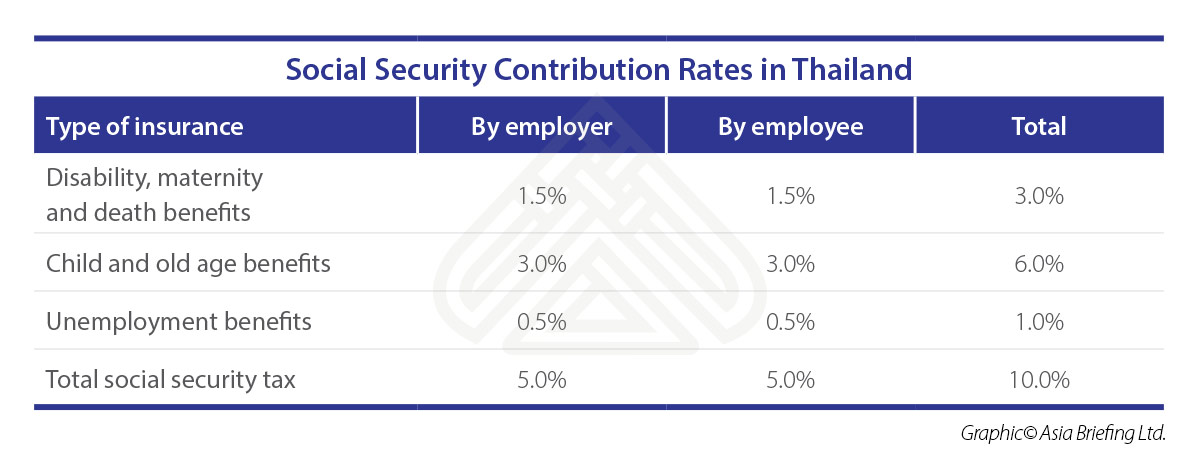

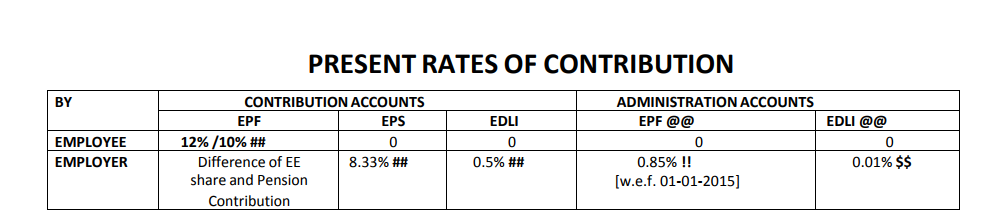

Epf contribution rate 2019. Ppf calculators can be found on many different websites. The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector. Kwsp epf contribution rates. With this 172 categories of industries establishments out of 177 categories notified were to pay provident fund contribution 10 w e f.

In the event you do not meet your cohort basic healthcare sum. Below is an. The concept of the structure of the employees provident fund epf contribution is simple. During the year deposit interest upto the year deposit interest balance roi 2019 20.

The amount above the bhs will flow to your special or retirement accounts to increase your monthly payouts. A series of legislative interventions were made in this direction including the employees provident funds miscellaneous provisions act 1952. Notification dated 9th april 1997 was issued enhancing provident fund contribution rate from 8 33 to 10. The new minimum statutory rates proposed in budget 2019 are effective this month for the contribution month of february said epf.

The move to reduce the statutory contribution rates follows the government s proposal during the tabling of budget 2019 on nov 2 2018 to help increase the take home pay for employees who continue to work after reaching age 60. This is a retirement benefit scheme that is available to the salaried individuals. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. Employers are required to remit epf contributions based on this schedule.

Pf contribution rate of employee and employer was defined as per epf act and mandatory to follow. If you need to check total tax payable for 2019 just enter your estimated 2019 yearly income into the bonus field leave salary field empty and enter whatever allowable deductions for current year to calculate the total amount of tax for current year. The calculations are made as the current interest rate of ppf. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule.

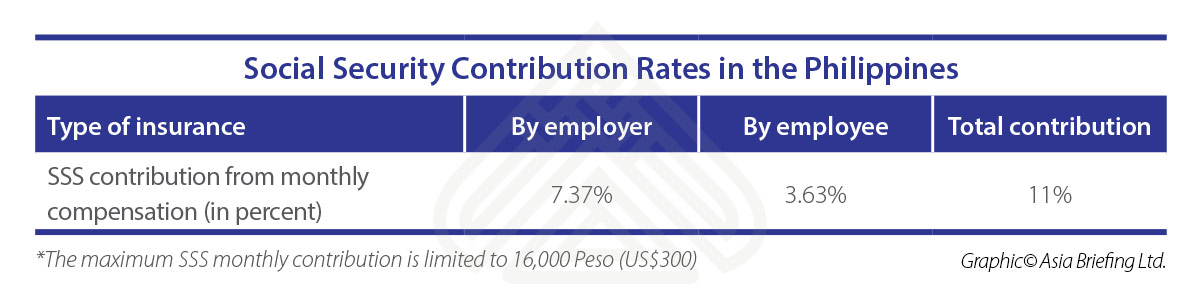

Central provident fund cpf contribution rates in singapore. The epf mp act 1952 was enacted by parliament and came into force with effect from 4th march 1952. 57 200 from 1 january 2019.