Epf Employer Contribution Rate 2019 Malaysia

Kwsp epf contribution rates.

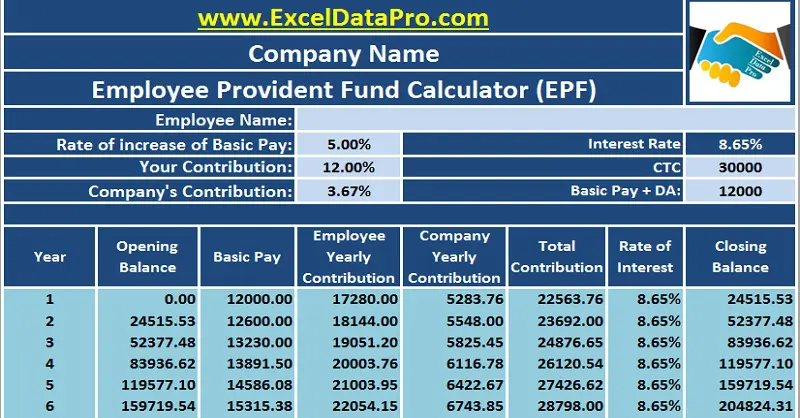

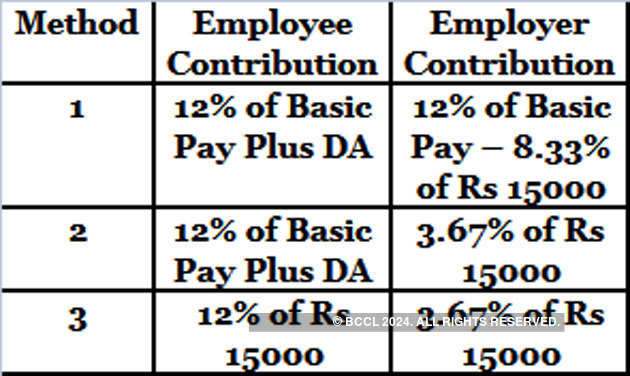

Epf employer contribution rate 2019 malaysia. The minimum employers share of the employees provident fund epf statutory contribution rate for employees aged 60 and above has been reduced to 4 per month. Employee contribution epf 12 20000 2400 employer contribution eps 8 33 15000 1250 difference 2400 1250 1150 total employer pf 1250 1150 2400 note even if pf is calculated at higher amount for eps we will take 15000 limit only remaining amount wil go to difference. For the exact contribution amount refer to the contribution schedule jadual or head over to the epf contribution website. 12 ref contribution rate section a.

6 5 ref contribution rate section c more than rm5 000. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. The minimum statutory contribution by employers to malaysia s employees provident fund epf for employees aged above 60 will be reduced to 4 per month down from the previous 6. Employers are required to remit epf contributions based on this schedule.

For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13. The malaysian government has reduced the minimum employee contribution rate for the employees provident fund epf to 7 starting from april 1 in a bid to cushion the impact of the covid 19. 13 ref contribution rate section a applicable for ii and iii only employees share. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download.

Written by staff writer. Ref contribution rate section e rm5 000 and below. January 07 2019 16 04 pm 08. Effective from january 2018 the employees monthly statutory contribution rates will be reverted from the current 8 to the original 11 for employees below the age of 60 and from 4 to 5 5 for those aged 60 and above.

Currently employees contribute 11 of their salary to epf while employers must put in a minimum of 12 for salaries more than rm5 000 and 13 for salaries.