Epf Employer Contribution Rate 2019

12 ref contribution rate section a.

Epf employer contribution rate 2019. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. You should note that employee contribution of 12 is mandatory. Pension contribution is not to be diverted and total employer share goes to the pf. If the monthly salary of a person is rs 30 000.

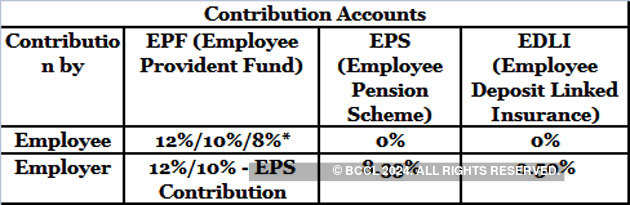

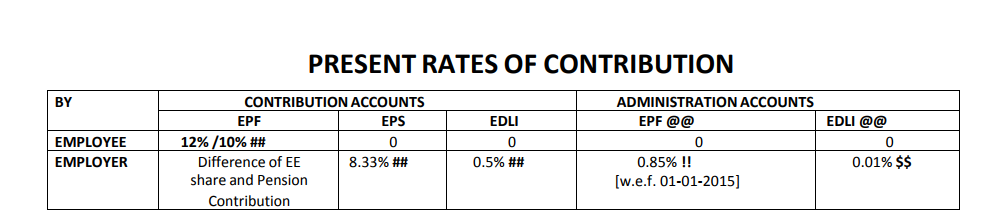

Employees provident fund contribution rate. 12 employer s contribution includes 3 67 epf and 8 33 eps. Employee s deposit link insurance scheme edlis. Employee s pension scheme eps.

Apply jointly to contribute cpf at higher rates for 1st 2nd year singapore permanent resident spr p form jap 94 p p this form is for employers who have signed up for eservice in the corppass portal. Ref contribution rate section e rm5 000 and below. In both the cases the pension contribution 8 33 is to be added to the employer share of pf. A series of legislative interventions were made in this direction including the employees provident funds miscellaneous provisions act 1952.

Usually employer contribution will be 12 of basic pay or 12 of rs 15000. The employer has to contribute 12 of the basic salary towards epf. The move to reduce the statutory contribution rates follows the government s proposal during the tabling of budget 2019 on nov 2 2018 to help increase the take home pay for employees who continue to work after reaching age 60. Interest rate on epf for fy 2019 20.

But employer contribution cannot be more than the amount mentioned among the 3 methods. The employer contribution break up is mentioned below employee s provident fund epf. Employers are required to remit epf contributions based on this schedule. Labour ministry notified the interest rate on employees provident fund epf to be 8 65 for the year 2018 19.

Employee contribution epf 12 10000 1200 employer contribution eps 8 33 10000 833 difference 1200 833 367 total employer 833 367 1200. Whereas employer contribution to epf will be 3 67 of rs 15000. When an eps pensioner is drawing reduced pension and re joins as an employee. Employee can increase his contribution as he want.

The epf mp act 1952 was enacted by parliament and came into force with effect from 4th march 1952.