Income Tax 2017 Relief

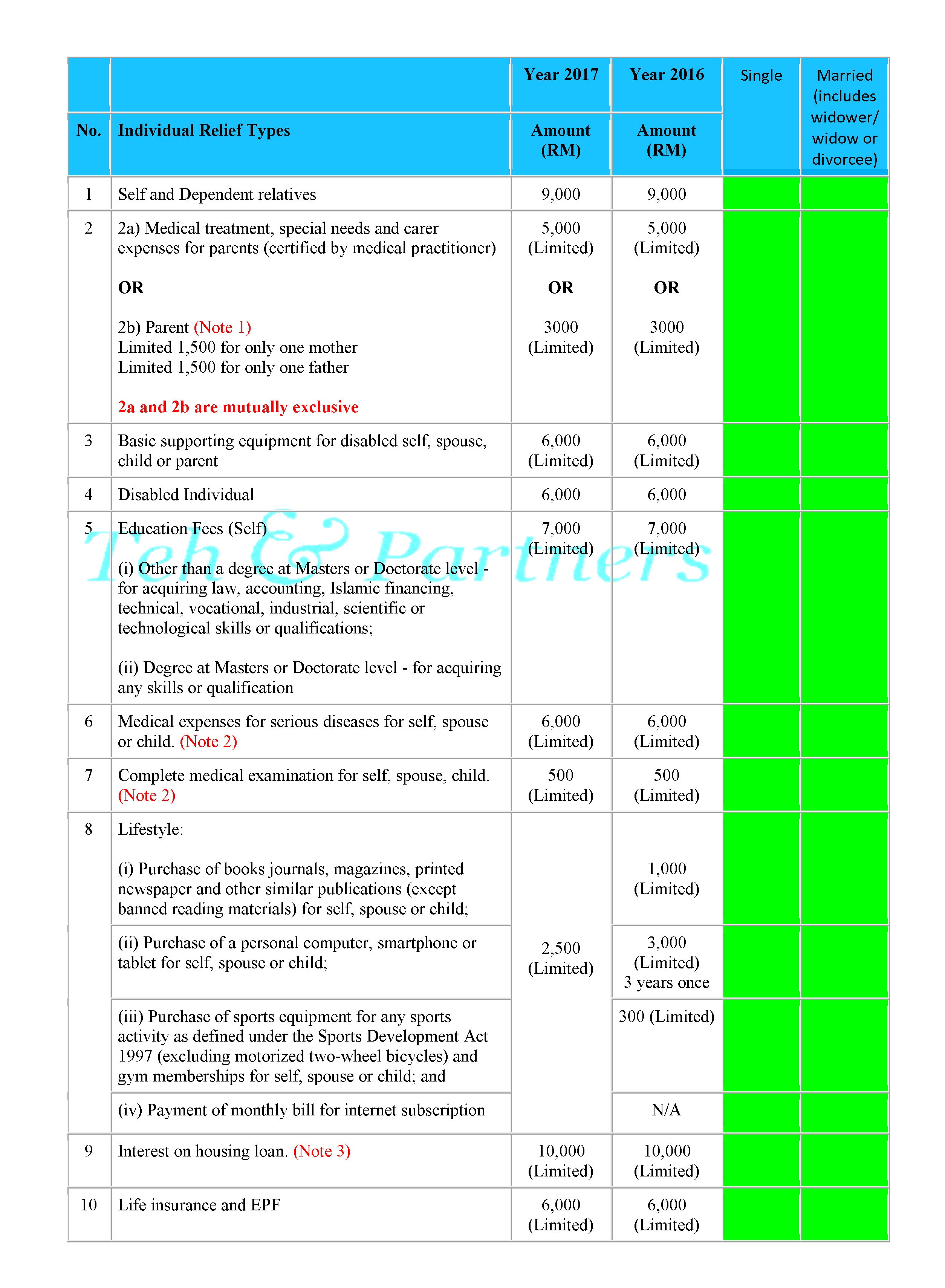

For year of assessment 2016 and before only individuals with a monthly income of rm3 800 and above would have enough chargeable income to utilise the rm1 300 or rm4 300 tax relief.

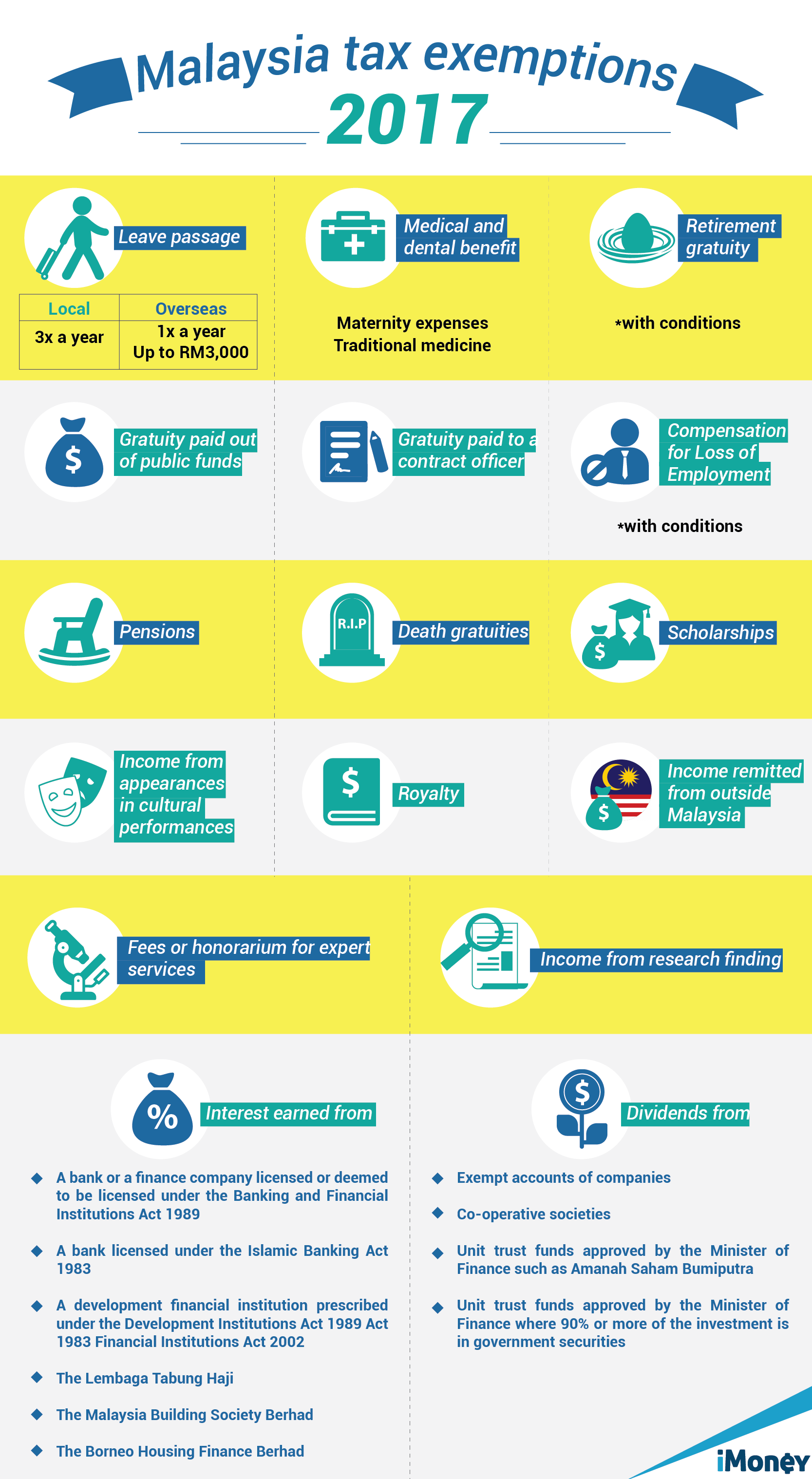

Income tax 2017 relief. Malaysian government imposes income tax rebates for resident individual as below for 2017. This cap applies to the total amount of all tax reliefs claimed including any relief on cash top ups made on or after 1 jan 2017. She claims nsman wife relief wmcr and foreign maid levy relief. Income tax department relief under section 89 income tax department tax tools relief under section 89.

Please also note that there is a personal income tax relief cap of 80 000 which will apply from the year of assessment ya 2018 onwards. The tax rebate is calculated based on the following. Mrs chua is a singapore tax resident. The maximum amount of relief phil can set against his total income for 2016 to 2017 is 50 000 as this is the greater of 50 000 and 25 of his income.

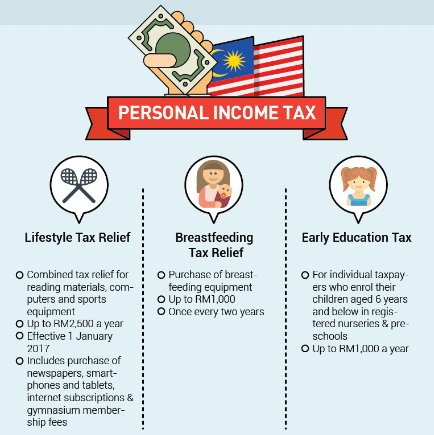

Medical expenses for parents. Malaysia s prime minister presented the 2017 budget proposals on 21 october 2016 offering up some new relief measures in the form of new lifestyle tax deductions to taxpayers. The remaining 10 000 loss can be carried. Personal circumstances 2020 2019 2018 2017.

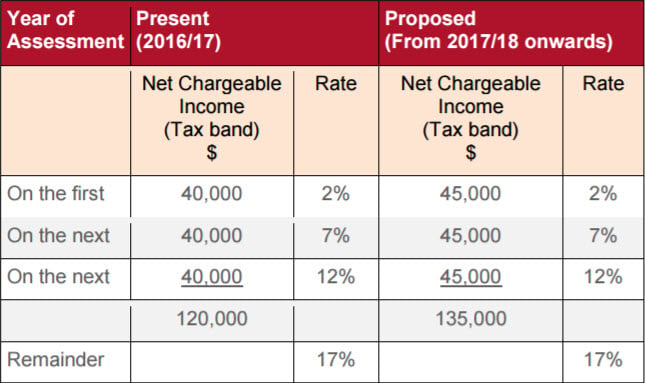

The comparison of her tax computations for ya 2017 and ya 2018 is as follows. The tax relief is aimed to ease the burden of parents with children of up to 6 years old and can be claimed by either parent of the children starting from. Tax rates and rate bands. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card.

We ve listed seven of the things you can spend more to save on your 2017 income tax but of course there are plenty more things listed on the 2017 income tax relief which you can view here. For 2017 she had the same income and claimed the same reliefs. Parent limited 1 500 for only one mother. 1 why this matters.

The amount of tax payable after double taxation relief dtr and other credits. The amount of tax payable before offsetting the parenthood tax rebate. Starting from year of assessment 2017 the lifestyle tax relief includes individual with a monthly income of rm3 600 and above said choong hui yan a tax consultant from simways formulation. Income tax offices.

Calculating your income tax gives more information on how these work.