Internet Subscription Tax Relief Malaysia

The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills.

Internet subscription tax relief malaysia. Which prepaid bigbonus internet plans is purely for monthly internet subscription only. Because this is the most comprehensive and practical guide on income tax relief in malaysia for the non tax savvy you yes you. But digi said prepaid bigbonus internet plans not entitled for this lifestyle tax relief. Subscription of broadband internet gymnasium membership fee.

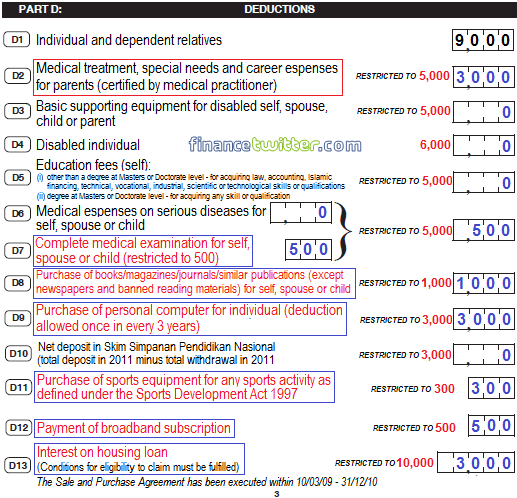

Subject to the following conditions. It clarifies that individual employee who receives benefit on using the broadband 1 registered under the name of employer and 2 the fee is paid by employer is exempted from tax. If you digest this by dec this year. Subscription fees for broadband registered in the name of the individual with effect from year of assessment 2010 2012 500 limited 14.

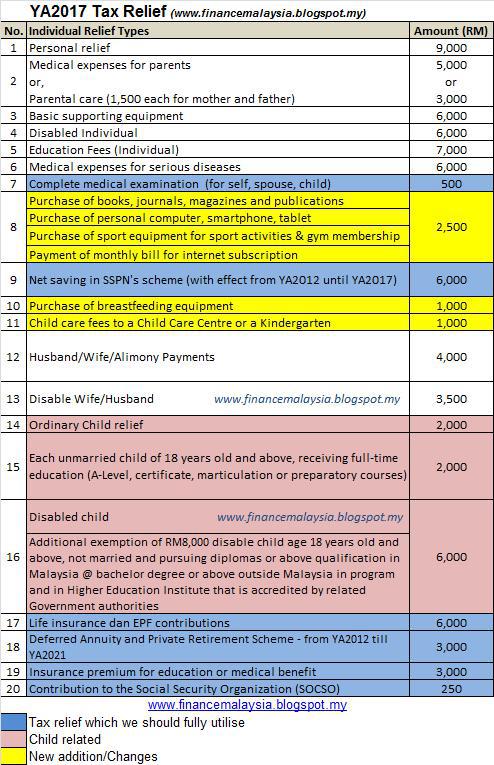

Interest expended to finance purchase of residential property. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax. The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too. Iv payment of monthly bill for internet subscription.

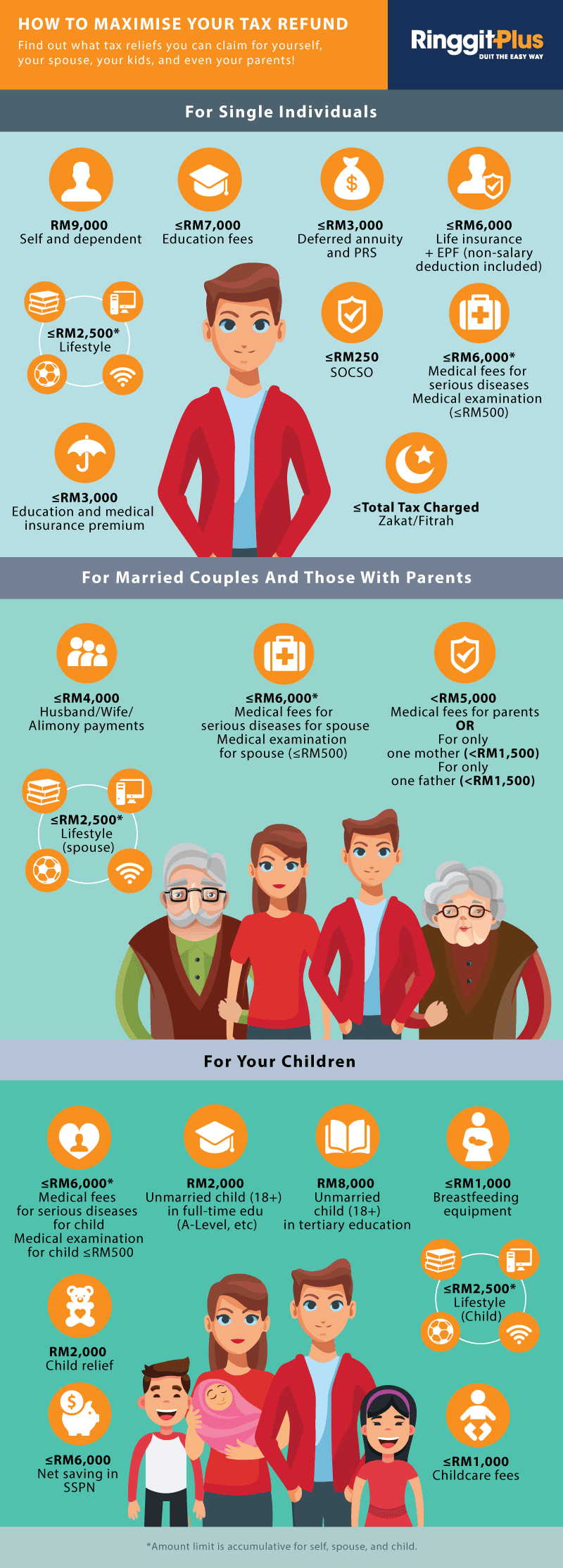

As per inland revenue board of malaysia official portal lifestyle covered a few items as per attached. Internet subscription paid through monthly bill registered under your own name. Now this tax relief is probably one that we would use the most. Buying reading materials a personal computer smartphone or tablet or sports equipment and gym memberships for yourself spouse or child allows you to claim for tax relief.

Wow sounds like a lot of stuff. You can get up to rm2 500 worth of tax relief for lifestyle expenses under this category. Malaysia inland revenue board irb on 12 april 2011 issued a technical guideline on personal tax relief or deduction on the broadband subscription fee. Rm 2 500 including child spouse 1.

Effective for year of assessment 2017 tax filed in 2018 the lifestyle tax relief at a limit of rm2 500 yearly also includes new categories such as the purchase of printed newspapers smartphones and tablets internet subscriptions as well as gymnasium membership fees. Internet subscription paid through monthly bill registered under your own name. Under this category items that are applicable include books magazines printed newspapers purchase of personal computer smartphone or tablet buying sports equipment or gym memberships and your monthly internet subscription. Refer to this list of the income tax relief 2018 malaysia.

Reliefs are available to an individual who is a tax resident in malaysia in that particular ya to reduce the chargeable income and tax. Relief of up to rm10 000 a year for three consecutive years from the first year the interest is paid.