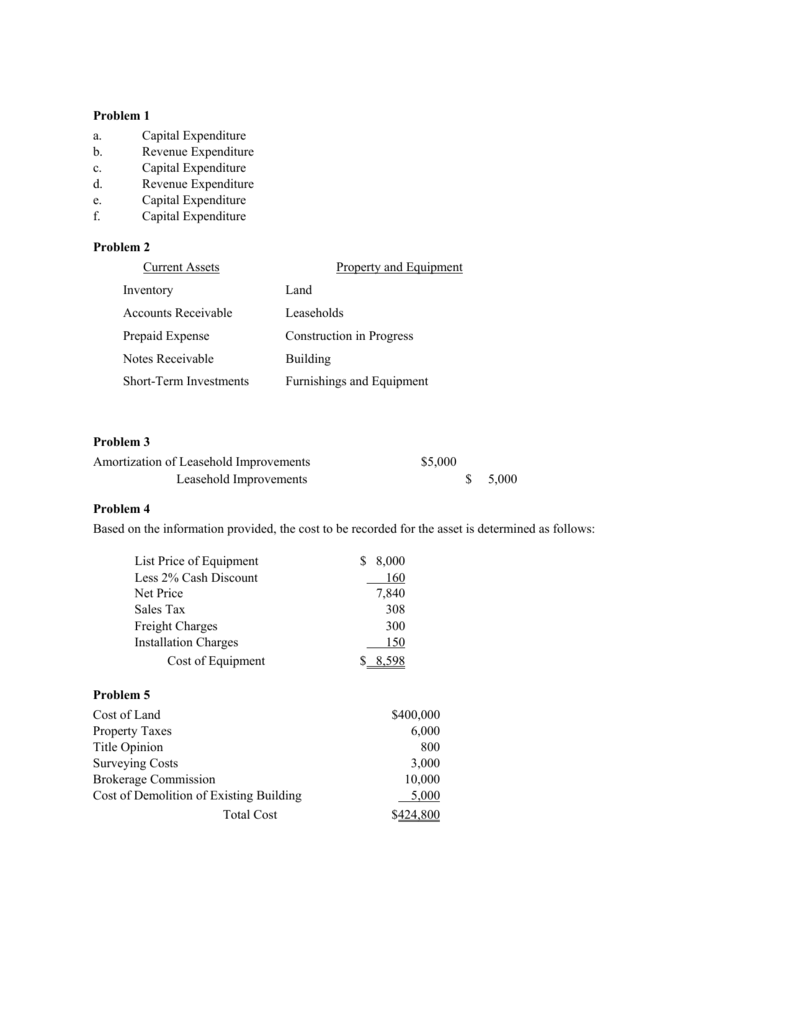

List Of Capital Expenditure And Revenue Expenditure

Capital expenditure may include the following expenditures expenditure incurred on the acquisition of fixed assets tangible.

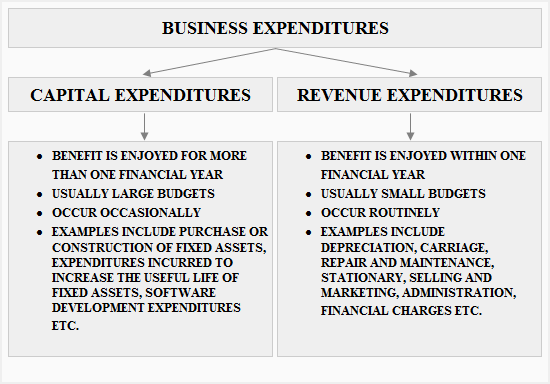

List of capital expenditure and revenue expenditure. So far we ve spoken mainly about physical revenue expenditures. But the range is wider than that. An expenditure is a capital expenditure if the benefit of the expenditure extends to several trading years. Such assets include things like property equipment and infrastructure.

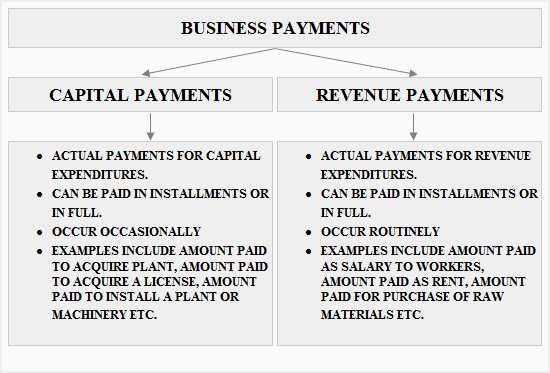

Routine repair update costs on equipment. Capital expenditure may include the following. Usually the cost is recorded in a balance sheet account that is reported under the heading of property plant and equipment. In the case of a capital expenditure an asset has been purchased by the company which generates revenue for upcoming years.

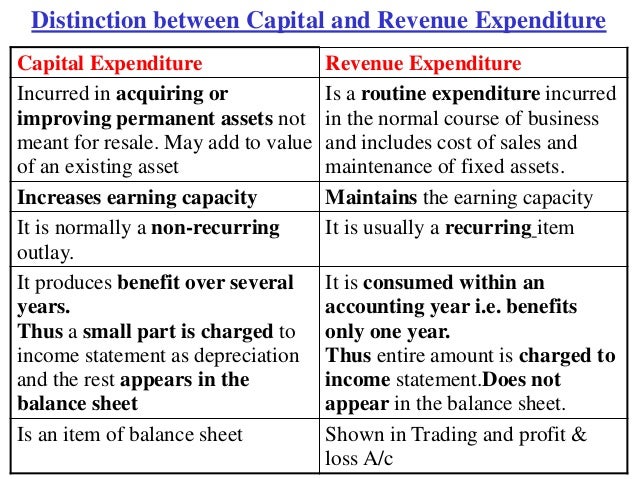

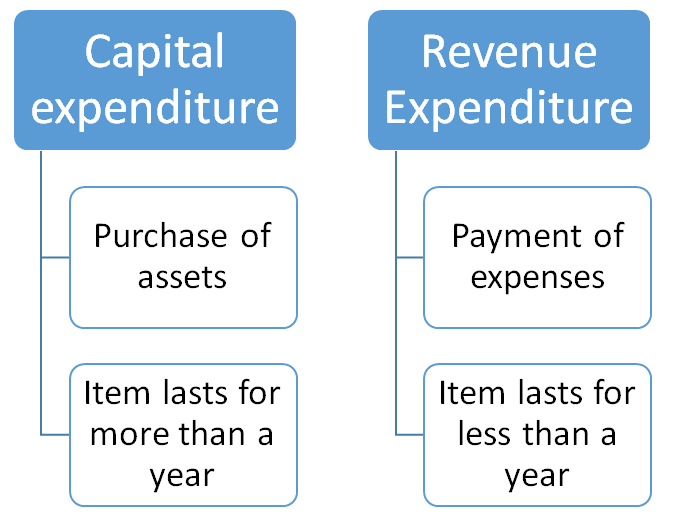

What is a capital expenditure versus a revenue expenditure. A capital expenditure is an amount spent to acquire or significantly improve the capacity or capabilities of a long term asset such as equipment or buildings. A capital expenditure capex is the money companies use to purchase upgrade or extend the life of an asset. Capital expenditure and revenue expenditure both are important for business for earning a profit in the present as well as in subsequent years.

Purchase costs less any discount received delivery costs. Smaller scale software initiative or subscription. Revenue expenses are short term expenses to meet the ongoing operational costs of running a business. Rent on a property.

Both have its own merits and demerits. Capital expenditures are a long term investment meaning the assets purchased have a. Definition of capital expenditure. Examples of revenue expenditure are salaries of government employees interest payment on loans taken by the government pensions subsidies grants rural development education and health services etc.

Revenue expenditure refers to those expenditures which are incurred during normal business operation by the company benefit of which will be received in the same period and the example of which includes rent expenses utility expenses salary expenses insurance expenses commission expenses manufacturing expenses legal expenses postage and printing expenses etc. Capital expenditure is money used to buy improve or extend the life of fixed assets in an organization and that has a useful life for one year or more. Capital expenditure as opposed to revenue expenditure is generally of a one off kind and its benefit is derived over several accounting periods. Capital expenditures usually take two forms.

Examples of revenue and capital expenditures. Maintenance expenditures and expansion expenditures. Cost of goods sold.

:max_bytes(150000):strip_icc()/TSLACF-----063329aec6ea4dabb3170b1e65b8246d.jpg)