Money Lending Act Malaysia

The money lending business in malaysia has been in existence since before independence.

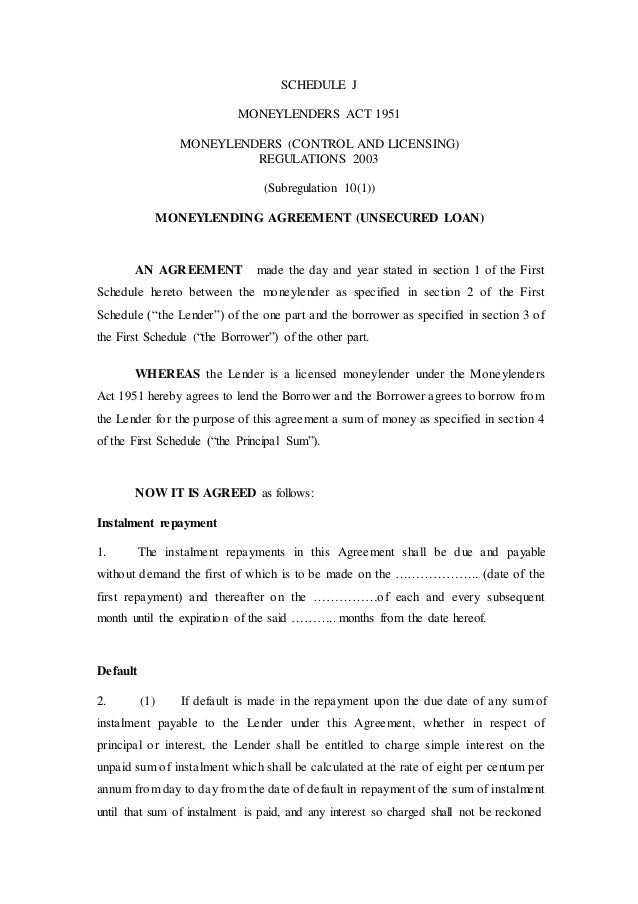

Money lending act malaysia. 79 1952 part i preliminary short title and application 1. Moneylenders under the act are only entitled to charge simple interest between 12 to 18 per annum depending on whether security for the loan is provided or not. B any person licensed approved registered or otherwise regulated by the authority under any other written law to the extent that such person is permitted or authorised to lend money or is not prohibited from lending money under that other written law. Garis panduan dan borang dari bank negara malaysia di bawah akta pencegahan pengubahan wang haram 2004.

Peninsular malaysia 31 march 1952 l n. This act may be cited as the loan local act 1957. Cannot be convicted of a crime involving fraud or dishonesty. Laws of malaysia act 648 loan local act 1957 an act to authorize a sum of two hundred million ringgit to be raised in malaysia by way of loan for certain public works and for other purposes.

Laws of malaysia act 400 moneylenders act 1951 an act for the regulation and control of the business of moneylending the protection of borrowers of the monies lent in the course of such business and matters connected therewith. The malaysian money lenders association was established on 14th august 2003. The exact rules are a bit long but you can find them under section 9 of the ma. 19 december 1957 part i preliminary short title 1.

Money lending business is governed under the moneylenders act 1951 and administered by the ministry of urban wellbeing housing and local government. Any body corporate incorporated or empowered by an act of parliament to lend money in accordance with that act. Cannot be convicted of an offence against a body or property in the penal code chapters xvi and xvii cannot be a bankrupt. In short a moneylender.

Standard guidelines anti money laundering and counter financing of terrorism aml cft anti money laundering and counter financing of terrorism aml cft sectoral guidelines 8. An act for the regulation and control of the business of moneylending the protection of borrowers of the monies lent in the course of such business and matters connected therewith. It was operated in small scales by moneylenders who are commonly known as chettys. In malaysia moneylending an activity of lending money with interest with or without security by a licensed moneylender to a borrower as defined by the moneylenders act 1951 are often confused with loan sharking.

The act also clearly defines the scope of a moneylender s activities and business operations regardless if the person is an employee agent or owner of a moneylending business including sources of income from the business.