Which Allowance Is Exempt From Epf

I consumable business products of the employer provided free of charge or at a partly discounted price to the employee his spouse and unmarried children.

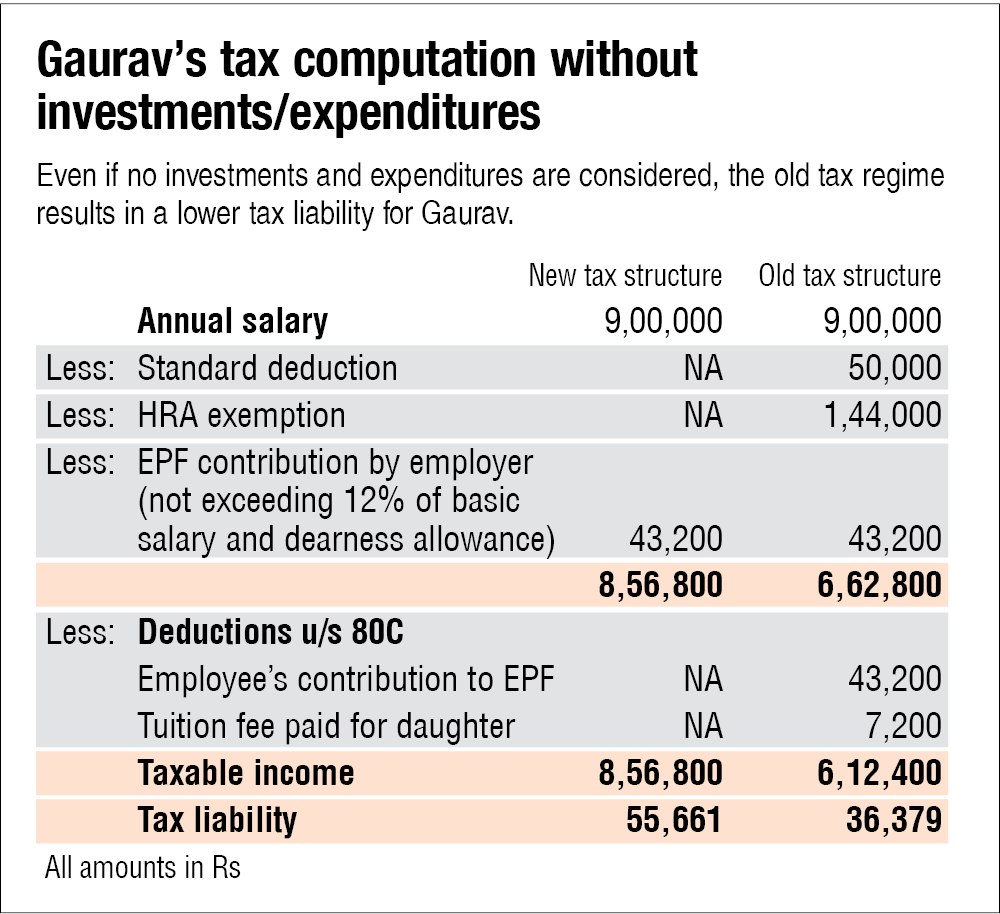

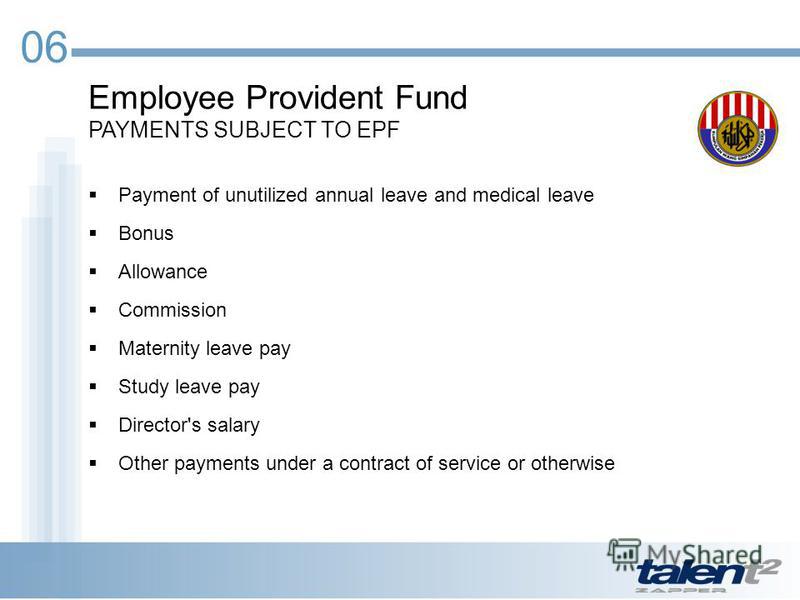

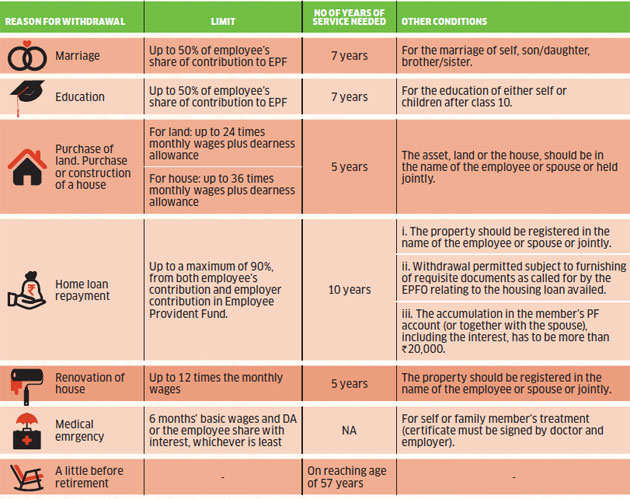

Which allowance is exempt from epf. All cash payments by whatever name called paid to an employee on account of a rise in the cost of living house rent allowance overtime allowance bonus commission or any other similar allowance payable to the employee in respect of his employment. Archive rules for statutory deductions exemptions on allowances perquisites archive. However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope. Dividends generated from epf are also exempted from tax.

As per the epfo act pf does not cover certain specified exclusions like cash value of any food concession. C epf contribution is that it qualifies for tax deduction by way of personal relief. Allowance except travelling allowance is included in the definition of wages under the epf act. Which payments are subject to epf contribution and which are exempted.

Epfo however circular does not clarify which these allowances are the flexibility exercised by employers and the provident fund authorities in the definition of basic wages has finally caught the attention of the employees provident fund organisation epfo. These contributions comprising the member s and employer s share will be credited into the member s epf account. Payments exempted from epf contribution. In general all monetary payments that are meant to be wages are subject to epf contribution.

Allowances except a few see below commissions. B epf is a great way to get someone other than yourself namely your employer to contribute to your retirement. Allowance except travelling allowance is included in the definition of wages under the epf act. Epf members in the private and non pensionable public sectors contribute to their retirement savings through monthly salary deductions by their employers.

However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope. Payments subject to epf contribution. Not all allowances exempt from pf.