Assessment And Quit Rent

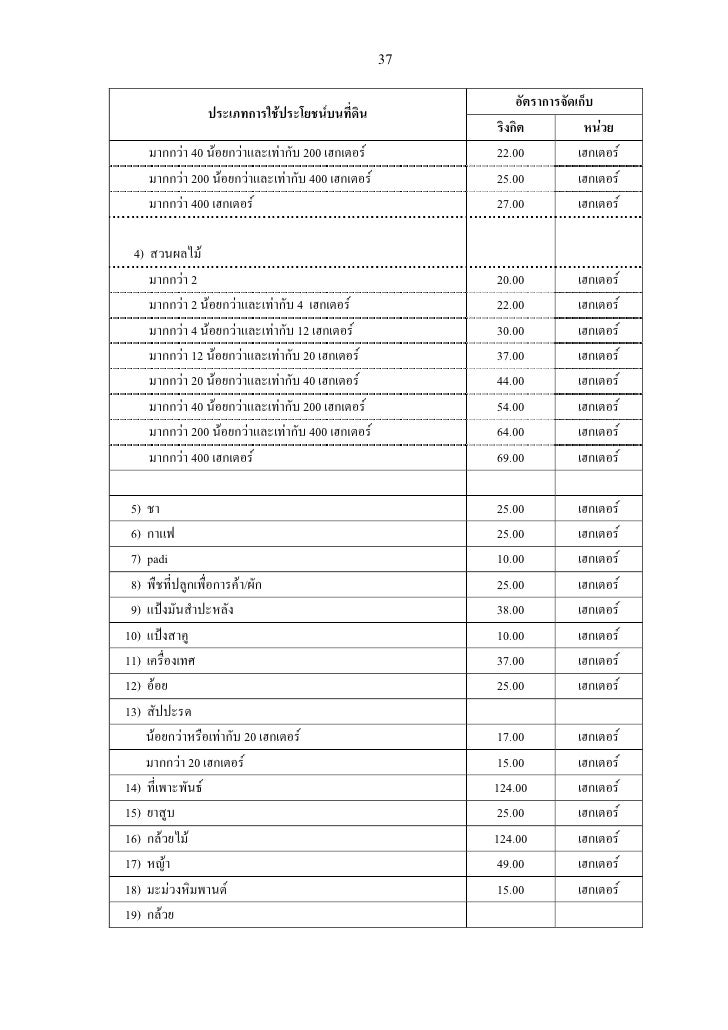

A local property tax which applies to all properties and is calculated on an annual rate of one to two sen per square foot.

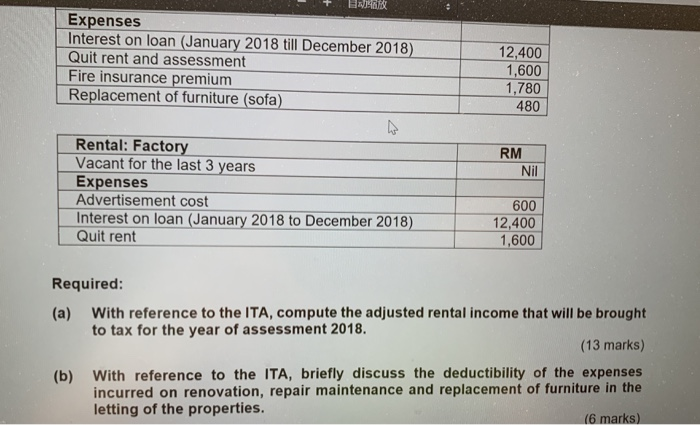

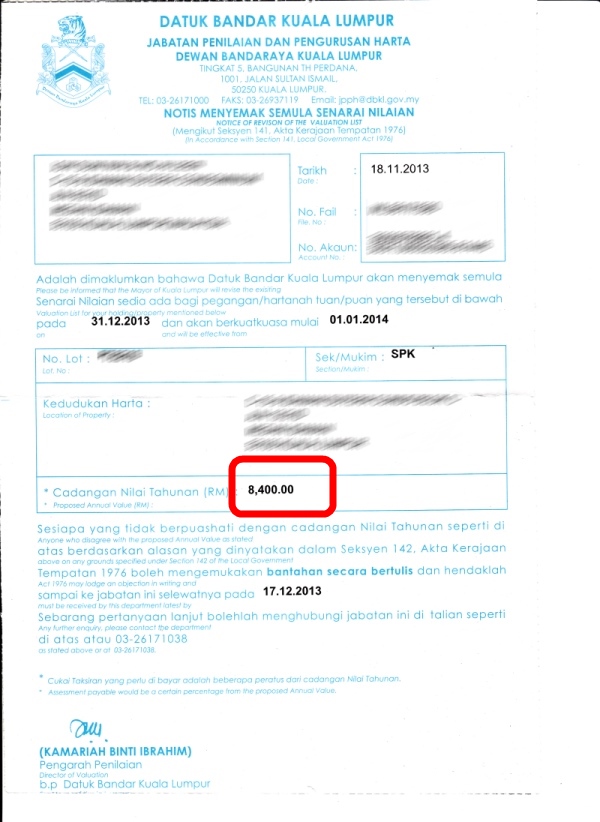

Assessment and quit rent. Assessment rates or cukai pintu is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services. It must be paid by the landlord to the state authority via the land office and is payable in full amount from 1 st january each year and will be in arrears from 1 st june each year. It is a form of land tax collected by state governments and is imposed on owners of freehold or leased land. To put it simply parcel rent is actually a type of quit rent that is specifically meant for strata properties which are governed by the strata management act sma 2013 and the strata titles act sta 1985.

Letting of real property as a non business source 5 1 the letting of real property is treated as a non business source and income received from it is charged to tax under paragraph 4 d of the ita if a person. Btw tanah cukai and quit rent is the same. Under feudal law the payment of quit rent latin quietus redditus pl. Those who pay either tax after the due date must pay a fine.

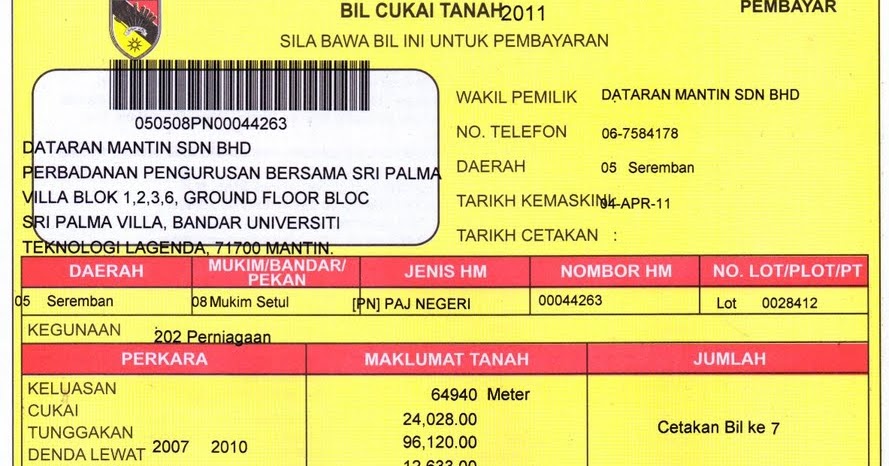

Quit rent cukai tanah is a tax imposed on private properties. Now that it s may we feel it s a good time to talk about that other bit of tax we get hit with every year the quit rent or cukai tanah. What is cukai tanah. Quit rent liability is generally less than rm 100 00 annually.

It s all in the name. The bill is yellow in colour. Quit rent and assessment tax is due by a certain date each year without demand from the government. And does not include building for the purpose of living accommodation.

Your jmb will pay on behalf for all to land office coz under strada title. Cukai tanah literally translates to land tax which is a tax levied on the land that s in use upon whoever is using it. You only pay your assessment fee or cukai pintu to local council like mbpj or dbkl by your own. Quit rent cukai tanah besides the assessment tax the other main cost associated with property and land ownership in malaysia is quit rent or cukai tanah.

U dont pay ur tanah cukai or quit rent in local council. Land and property owners must known state due dates and assessment rates and act of their own volition in paying the tax. Quit rent quit rent or quitrent is a tax or land tax imposed on occupants of freehold or leased land in lieu of services to a higher landowning authority usually a government or its assigns.