Best Retirement Plan Malaysia

A retirement plan is a savings and investment plan that provides income during retirement.

Best retirement plan malaysia. Use our handy calculator to work out the amount you ll need to comfortably enjoy your golden years. Prs is made available to all malaysians who are employed and self employed. Best retirement plans for disability payout guaranteed income ntuc income gro retire ease formerly ntuc revoretire why is ntuc income gro retire ease good. It is created by insurance companies with a defined benefit.

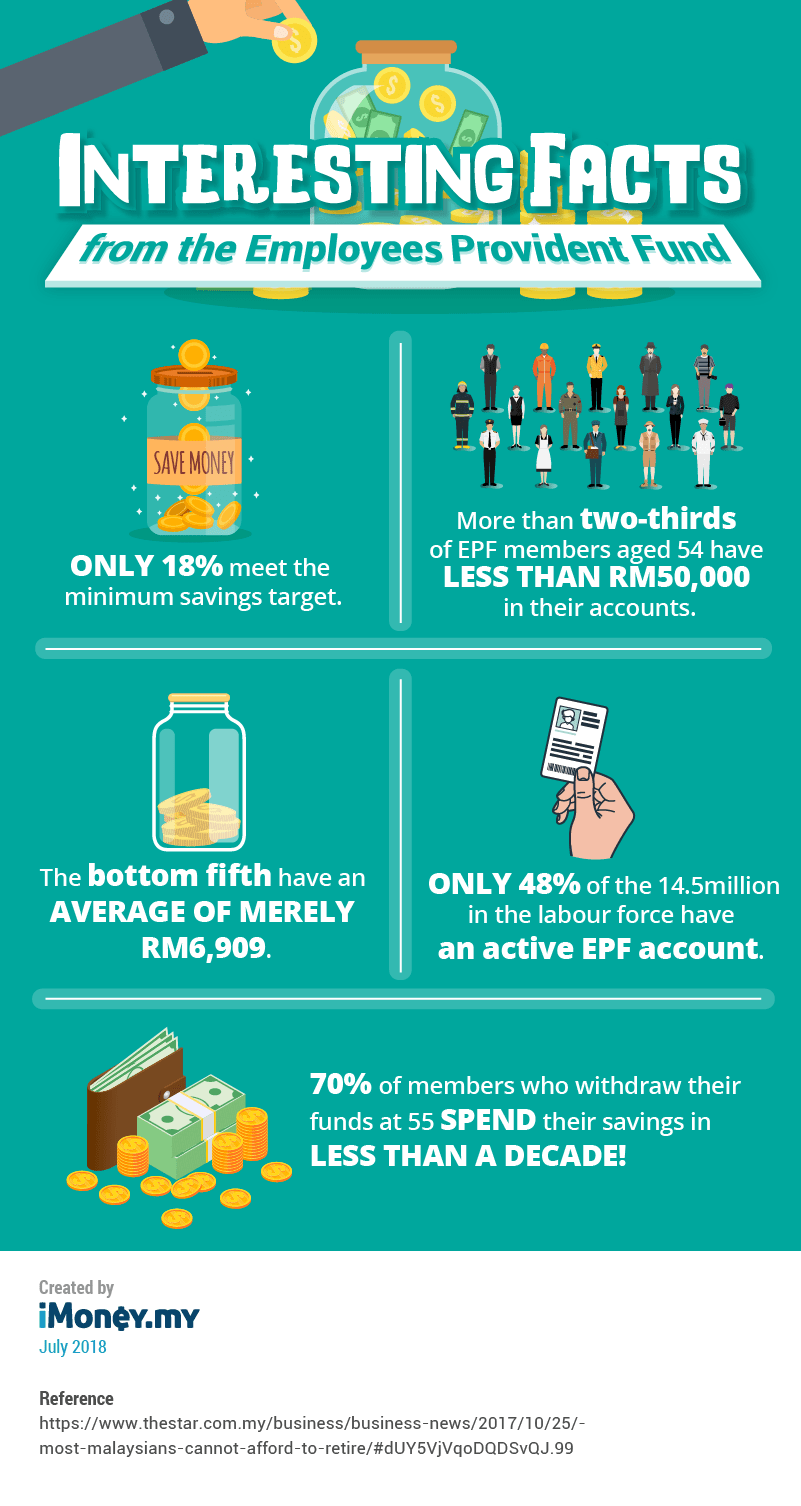

Prs offers the safest most flexible and regulated retirement saving scheme to accumulate your retirement funds. Last year the employees provident fund epf raised the minimum savings target to rm228 000 by the age of 55. In essence people are worried about retirement. Miscalculations in terms of your retirement fund can be caused by common misconceptions such as these.

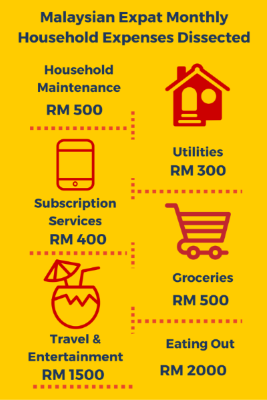

Great retirement plan will provide you a stream of guaranteed income to supplement your retirement fund. No less than 12 factors are taken into account when assessing potential destinations such as cost of living political life retirement benefits malaysia climate and healthcare all based on a couple of retirees living with at least 1 500 per month. Best retirement plan malaysia. With all the talk revolving around the epf withdrawal age lately the topic of the best retirement plan in malaysia seems to be on the tip of everybody s tongue.

Furthermore you can enjoy yearly annuity tax relief of up to rm3 000. There is no better time to start saving early to help you achieve your ideal retirement lifestyle. Neither prudential assurance malaysia berhad nor prudential plc is affiliated in any manner with prudential financial inc a company whose principal place of business is in the united states of america or with prudential assurance company a subsidiary of m g plc a company incorporated in the united kingdom. The demand for retirement homes in malaysia can only go up in view of the increasing number of senior citizens in need of retirement homes that are affordable with good quality related support services.

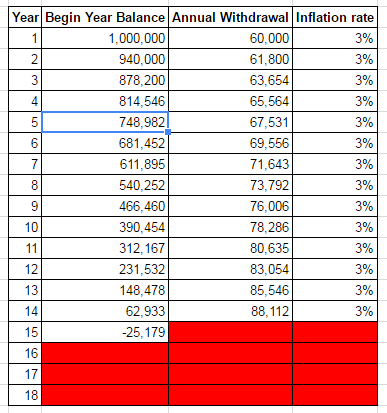

But the reality is that this phase of your life can bring big financial changes. So is your retirement fund sufficient. For example an insurance company can say that if you pay them x amount of dollars from now till you are age 55 they are going to give you a guaranteed monthly income of y dollars from your age 60 to 80 years old. Malaysia is one of the top 10 retirement destinations in the world based on the annual global retirement index for the year 2020.

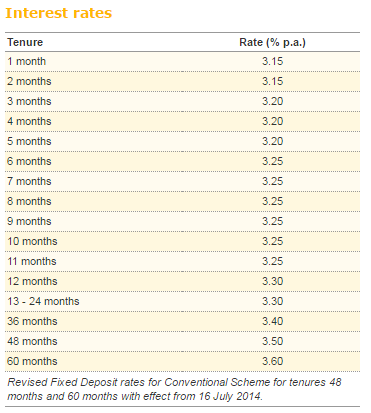

Highest in guaranteed income with a guaranteed yield at maturity of up to 2 70 p a you can be assured of a steady stream of income in the form of guaranteed monthly cash benefits during your payout period. This means a monthly retirement income of the only rm950 per month assuming a life expectancy of 75 years old. Prudential assurance malaysia berhad is an indirect subsidiary of prudential plc.