Unabsorbed Business Loss Carried Forward Malaysia Lhdn

Unutilised losses accumulated as at ya 2018 can be utilised for utilised for 7 consecutive yas and will be disregarded in ya 2026.

Unabsorbed business loss carried forward malaysia lhdn. Business losses can be set off against income from all sources in the current year. This is to minimise the revenue loss of the government in the sense that a business that continues to be loss making is unrealistic. Effective from ya 2019 the time limit is 7 yas. It is proposed that a time limit will be imposed as follows losses allowances proposal 1.

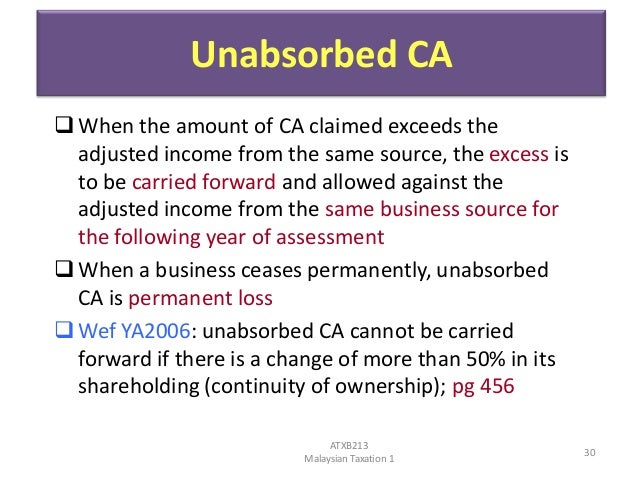

Utilisation of carried forward losses is restricted to income from business sources only. Finance minister lim guan eng tables budget 2019 at parliament in kuala lumpur november 2 2018 picture by shafwan zaidon. Unutilised business losses to be carried forward for a maximum of 7 consecutive 2. Utilisation of capital allowance is also restricted to income from the same underlying business source.

As a concession companies except dormant companies are allowed to carry forward unabsorbed tax losses even when there is a substantial change more than 50 in the shareholders. In ya 2019 xyz has unabsorbed business losses c f of rm600 000 from ya 2018. Interest payments arising from loans overdraft taken and used solely for business purposes or spent on the purchase of assets. Adjusted income loss from business xx 8 3 1 among the expenses which qualify for deduction under the general provision of subsection 33 1 of the ita for a business source are as follows a.

Business entities are allowed to carry forward unabsorbed losses and unutilised capital allowances in a year of assessment for a maximum period of seven years of assessment said minister of. The unabsorbed tax losses of the target company brought forward from previous years will be available to offset against future business income of the target company. On unutilised losses and allowances currently there is no time limit for carrying forward of unutilised losses and allowances. For companies in a loss making non tax paying position.

Wages and salary for staff. Any unutilised losses can be carried forward indefinitely to be utilised against income from any business source. Time limit to carry forward unabsorbed business losses and capital allowances ca corporate tax example xyz sdn bhd xyz started its business operation in year 2016. Any unutilised losses can be carried forward for a maximum period of 7 consecutive yas to be utilised against income from any business source.

The new amendments will be effective year of assessment 2019 where the unabsorbed business tax losses and unutilised capital allowance will only be allowed to be carried forward consecutively for seven years.