Gst Blocked Input Tax List

List given under section is discussed below.

Gst blocked input tax list. This time in gst a business unit will be eligible for input tax credit only if certain cases are met with the transactions. Those gst you can t claim is called blocked input tax credit. Expenses for use of club facilities. Membership of a club health and fitness center.

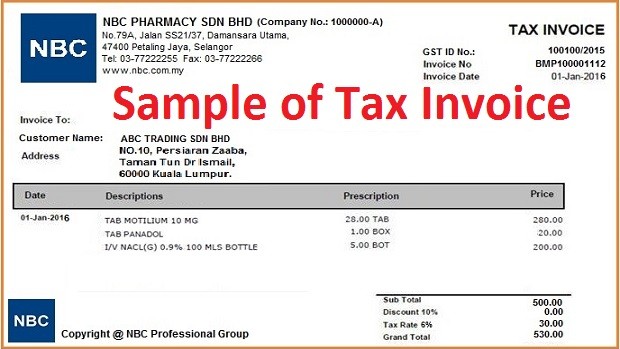

To implement this rule all the commissioners are required to make a list gstin wise of fake credit availers and block their itc under gst rule 86a. Input tax claims are allowed subject to conditions for input tax claim. Itc is used for payment of output tax. There are some goods services tax gst you can t claim even though you have already paid for it when you made your purchases or expenses.

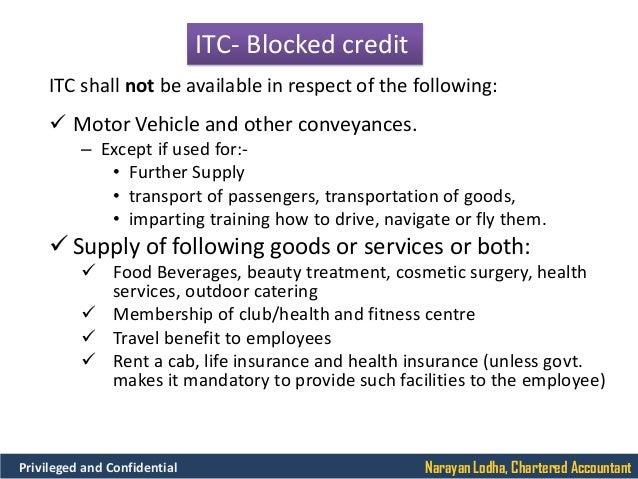

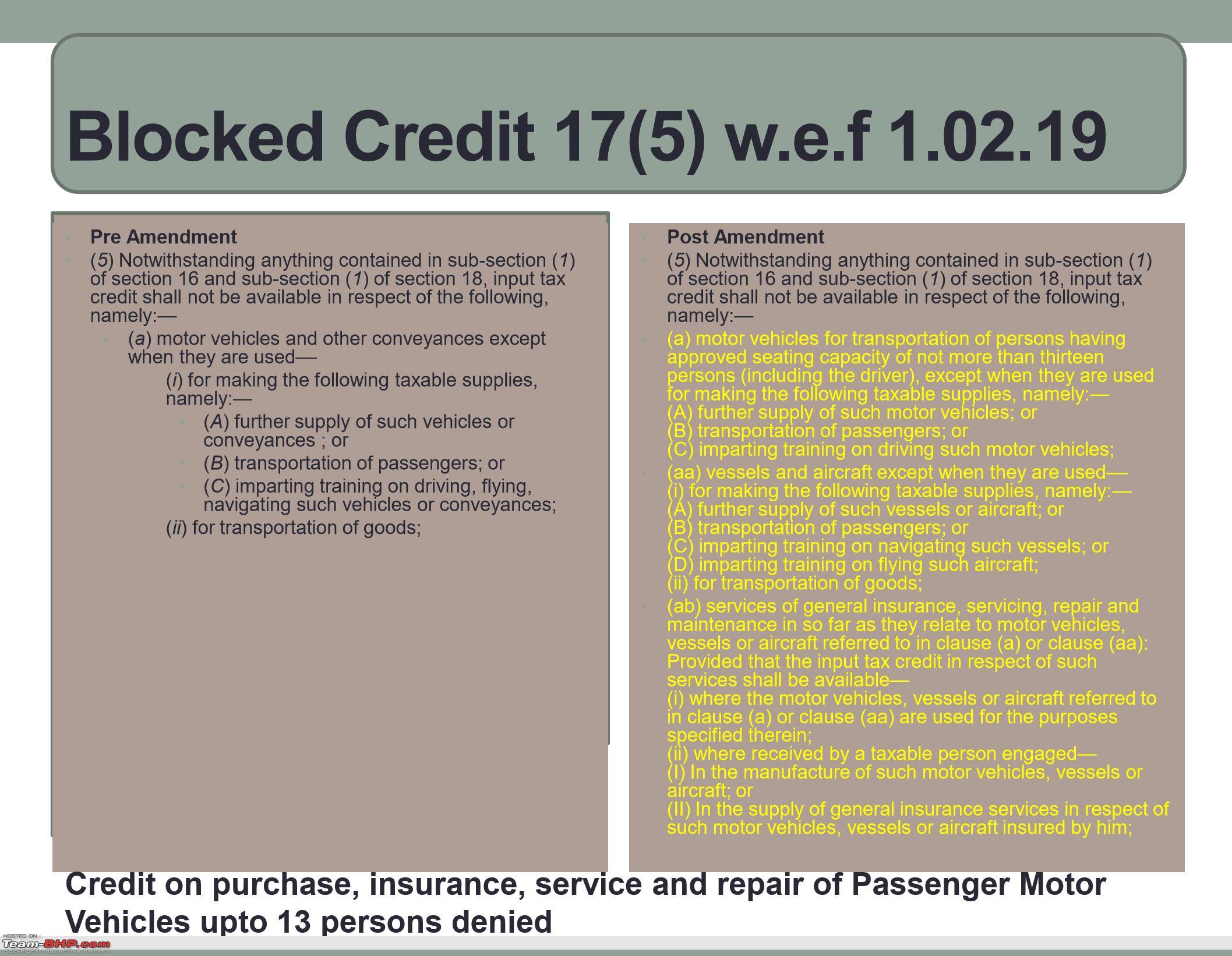

Input tax credit itc of the tax paid on almost all taxable supply of goods or services or both used in the course or furtherance of business is allowed under gst except the list of supply provided in section 17 5 of cgst act 2017. Gst registration reminder gst filing reminder gst automated blocked input tax claims 1. Itc of tax paid on almost every inputs and input services used for taxable supply of taxable goods or services or both is allowed under gst except a small list of items provided u s. Refer to the below table for further details.

No input tax credit is available for the following. All the commissioners will now have the facility to block unblock input tax credit availed by the taxpayer fraudulently by fake invoices or invoices without receipt of goods or services etc. Blocked credit list section 17 5 1. Section 17 5 of gst act deals with the blocking of itc on specified inward supplies.

Negative list of input tax credit under gst the article focuses on following areas. Supply or importation of passenger car including lease of. Under the gst category businesses are allowed to claim gst incurred on purchase of most. Input tax is defined as the gst incurred on any purchase or acquisition of goods and services by a taxable person for making a taxable supply in the course or furtherance of business.

14 blocked input tax credit itc under gst. Input tax claims are disallowed under regulation 26 of the gst general regulations. But there are some cases where itc is blocked so that recipient is not able to claim itc. 17 5 of cgst act.

Green fees buggy fees rental of golf bag locker and dining at club restaurants. Itc being the backbone of gst and there are many condition to claim itc on any items. This page is also available in. Acmefocus ne t pte ltd.

All decisions latest updates on 32nd gst council meeting get to know all major decisions taken in the 32nd gst council meeting discussed over gst threshold limit composition schemes and real estate.